Asset Mix Explained

Published on May 3, 2019

minute read

Share:

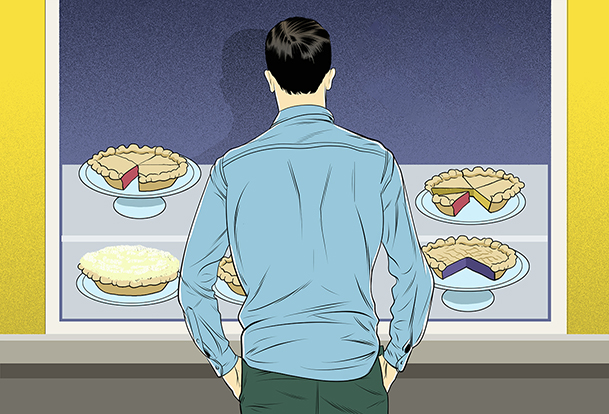

Before you select individual securities, mutual funds or exchange-traded funds (ETFs), it's a valuable exercise to determine what mix of investments is right for you. This is called your "asset mix" or "asset allocation."

Your asset mix is determined by your investor profile — the type of investor you are, the level of risk you're comfortable with, your investment goals and your time horizon. These details inform how you allocate your capital to the three main investment asset classes (equities, fixed income and cash) in your portfolio.

Here's how the three break down:

- Stocks (equities) can provide growth in your portfolio, but they tend to fluctuate in value more than other types of investments, so they come with more risk.

- Fixed-income investments (such as bonds and GICs) can help you preserve your capital and receive steady income, but they don't tend to grow as much as equities do.

- Cash investments tend to be very secure and offer liquidity, allowing you to take advantage of investment opportunities as they arise.

The main benefit of achieving an appropriate asset mix is diversification, which is important because financial markets typically don't move in the same direction at the same time. In a diversified portfolio, the positive performance of some investments could offset the negative performance of others. This can help reduce overall portfolio volatility.

As you build your portfolio, the Portfolio Analyzer tool can help you see what appropriate asset allocations might look like for an investor with similar objectives to yours.

Built by RBC Global Asset Management, each model is designed to balance risk and reward over time, and is updated annually to reflect changing markets. The models offer asset allocations aligned with five investor profiles, from very conservative to aggressive growth. Use the models to inform your investment choices, or choose the one that best aligns with your investor profile.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2023.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently a resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.