Active vs Passive Investing

Published on May 3, 2019

minute read

Share:

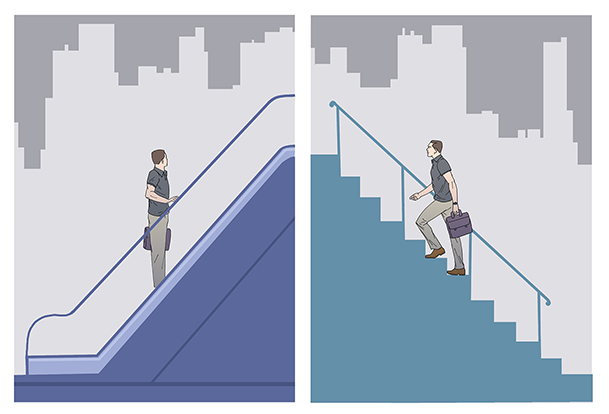

First off, a quick overview of just what it means when you hear active and passive investing. In short, active investing is generally a strategy focused on trying to beat the performance of the market. Passive investing, meanwhile, seeks to track or mirror a market index rather than beat it.

Many investors want to know if it's better to purchase an actively managed mutual fund or exchange-traded fund (ETF), or take the passive route and buy an index fund. Will the extra fees you pay for the expertise of a portfolio manager lead to higher returns, or should you just try to match the market?

This question has no definitive answer, but thinking about a few key considerations may help you reach your own conclusions.

For the long-term equity investor, the debate between active and passive strategies rests on three main considerations:

- Market efficiency

- Portfolio construction

- Historical performance

Find out more about each in in The Active versus Passive Debate.

There is no definitive answer on which approach is best. As a self-directed investor, it's up to you to choose the investment philosophy that fits your beliefs and your situation. Indeed, you may wish to mix actively and passively managed investments in your portfolio. Checking Fund Facts or the management company's website for clues about how an investment product is managed can help you determine if it's active or passive. Often, an ultra-low fee would be an indication of passive management, while higher fees are generally associated with active management.

Whether you're an active or passive investor, a variety of products can help you to achieve your investing goals. For tips on making investment choices, check out the Researching Investments Guide.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2023.

There may be commissions, trailing commissions, investment fund management fees and expenses associated with investment fund and exchange-traded fund (ETF) investments. On or after June 1, 2022, any trailing commissions paid to RBC Direct Investing Inc. will be rebated to clients pursuant to applicable regulatory exemptions. Before investing, please review the applicable fees, expenses and charges relating to the fund as disclosed in the prospectus, fund facts or ETF facts for the fund. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. For money market funds there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently a resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.