Growth vs Value Investing

Published on May 3, 2019

minute read

Share:

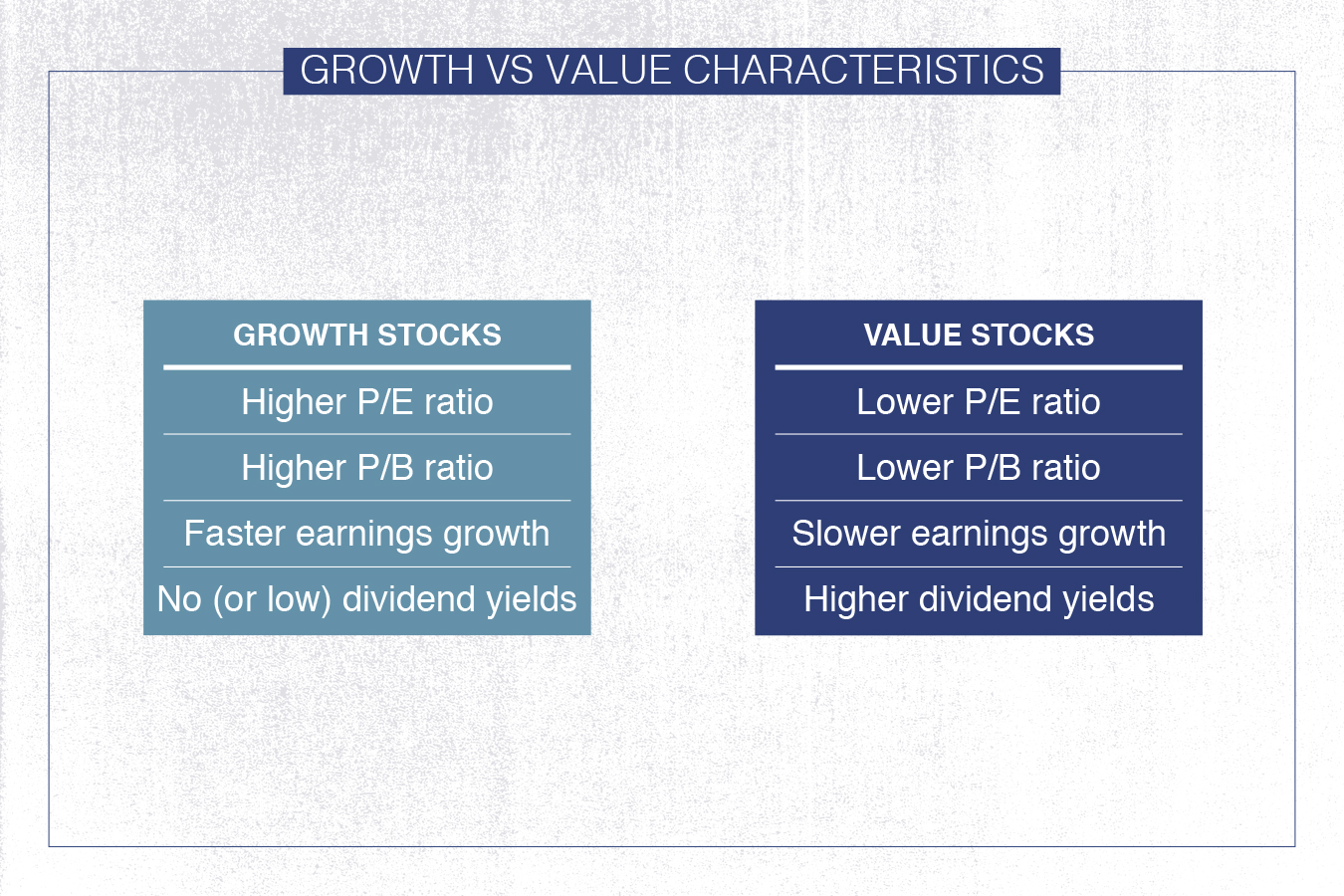

When it comes to choosing investments, growth and value investing are two common, but very different, investment styles. Value investors are interested in stocks that appear to be undervalued, while growth investors tend to look for companies that offer strong earnings growth. Let's take a look some of the specific characteristics of growth and value stocks.

Value Stocks

Value stocks can be found in nearly every industry. However, you're more likely to find them in industries that have recently fallen out of favour with investors or in industries that are facing a short-term market overreaction. Value stocks may have some of the following characteristics (as compared to a market index):

- Lower price/earnings (P/E) ratio

- Lower price-to-cash-flow ratio

- Lower price-to-book (P/B) ratio

- Higher dividend yield

Not all inexpensive stocks are value stocks, of course. Some companies experience price declines for good reason; perhaps it's a lack of confidence in management, increased competition, or the regulatory environment. A company's intrinsic, or true, value may indeed be as low as its share price implies.

Growth stocks

As the name implies, growth stocks are companies that investors expect will grow much faster than others. These companies are relatively new, or in rapidly growing industries (such as technology). Investors seek growth stocks for their future earnings prospects as compared to their industry and the overall market. Growth stocks typically don't pay dividends, but instead choose to reinvest their earnings in the business. Investors expect to profit from share price appreciation. Very high price valuations and higher volatility are often associated with these types of stocks.

Comparing Characteristics

One quick way to differentiate growth and value stocks is to compare their price/earnings (P/E) ratios, often considered a measure of how over- or undervalued a company's stock is. Imagine a company with annual reported earnings of $1 per share. The stock is priced at $5, which means it's trading at a 5-times P/E multiple, which might be considered low when compared to other stocks in the same industry. This low multiple suggests that the market does not expect earnings to grow very rapidly in the future. If the company's fundamentals are strong and consistent future earnings are likely, this could very well be a value stock.

Now imagine another stock with reported annual earnings of $1 per share. This stock is trading at $40, so the P/E multiple is 40-times. The high price-to-earnings ratio suggests that investors expect future earnings to grow substantially. This is very likely an example of a growth stock.

Where to Look

Whether you're searching for growth or value stocks, the Stock Screener can be a great resource. For example, you can use it to quickly screen for companies that have high or low P/E or P/B ratios. Or you can find companies that have seen strong recent share price appreciation.

The Fundamentals tab of a Detailed Quote will also show you break outs of the P/E and P/B ratios.

What's the Best Approach?

There are many successful growth and value investors. Still, both growth and value investors have lost money with investments that go in and out of favour. The approach that's right for you is up to you. However, if you find yourself torn between the two strategies, there's always a blended approach such as GARP, or growth at a reasonable price. GARP, as the name suggests, is a style of investing in which investors look for stocks with strong growth potential but don't want to pay too much for them.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2025.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. Information available on the RBC Direct Investing website is intended for access by residents of Canada only, and should not be accessed from any jurisdiction outside Canada.

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.