How to Analyze Your Investment Portfolio

Written by The Inspired Investor Team

Published on September 29, 2021

minute read

Share:

You'll often hear that diversification is one of the keys to long-term investing success. But how do you easily get an overall picture of your asset mix so you can assess risk and focus on what's right for you? Let the Portfolio Analyzer do the work!

What is the Portfolio Analyzer?

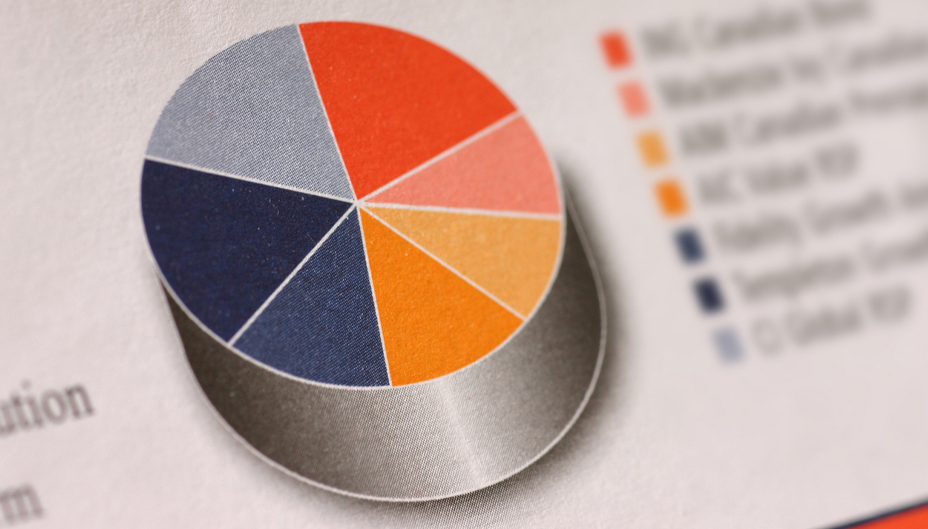

The Portfolio Analyzer allows you to see your overall mix of Canadian, U.S. and international stocks, fixed income securities and cash so that you can assess your level of diversification. You can choose to analyze a single account or a group of accounts to give you a big-picture view. Practice accounts can also be analyzed.

The tool allows you to see your asset mix at a glance and monitor for risks. (For example, how are you allocated across asset classes, regions and sectors?) You can also drill down to see factors like individual weights and holdings concentration. In addition, the comparison feature lets you compare your portfolio's asset mix and risk/return to six investor profiles created by RBC Global Asset Management (GAM), and to indices such as the S&P/TSX Composite, Dow Jones Industrial Average or S&P 500.

Where is it?

From your online account, go to the My Portfolio menu and select Portfolio Analyzer from under My Portfolio Holdings.

How to group accounts

To get the most out of the tool, it can help to combine, or group, your accounts into a portfolio view. To set up a group, go to My Portfolio in your online account and select Create and Manage Account Groups. Once in the Portfolio Analyzer tool, select the Account Groups button to view your asset mix. Drill down to see your exposure by country, industry sectors or individual securities.

Think of the Portfolio Analyzer as a tool that's useful for periodic check-ins with your portfolio to analyze your asset mix and monitor risks. It can help you make informed decisions and stay focused on your long-term objectives with a portfolio that's the right fit for you.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2025.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. Information available on the RBC Direct Investing website is intended for access by residents of Canada only, and should not be accessed from any jurisdiction outside Canada.

Explore More

5 Ways to Get More Out of Your RESP

How can you make the most of this investment vehicle? We explain.

minute read

There's an ETF for That!

Find out more about the options that are out there

minute read

ETF Trends from the RBC Capital Markets Trading Floor – May 2025

Here’s what we saw on the trading floor in May 2025

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.