Stocks, Shares or Equities: Call Them What You Want, This is What They Are

Published on May 6, 2019

minute read

Share:

Just so we're all on the same page, let's start with some of the terms you'll hear when it comes to equities. Some people call them "shares," others call them "stocks," and some just say "equity." Really, they all represent the same thing: part ownership in a company.

When you buy a stock — the term we'll use the most in this guide — you are participating in the future gains and losses of the company. Stocks are considered a higher-risk investment than fixed-income investments like bonds or guaranteed investment certificates (GICs), so investors tend to expect a higher rate of return in exchange for that risk.

Companies issue stock so they can raise money to run and grow the business. Every share in the company's stock represents a small part of the company's assets and earnings. The total value of stock held by the public is known as the company's market capitalization, or market cap.

A stock's value is based on a company's ability to generate profits, or earnings, which can be distributed to shareholders in the form of dividends or special cash distributions.

However, some companies don't distribute their earnings to shareholders. Instead, some choose to reinvest their profits back into the company, with hopes that the reinvestment will result in greater future earnings and a higher stock price in the future.

Types of Stocks

There are two main types of stocks: common and preferred.

Common: Also known as ordinary stock, common shares typically give investors the right to vote on significant company decisions such as board members or acquisitions. A company can have more than one class of common stock — for example, Class A and Class B — which can come with different voting rights and dividend payment structures.

Common stock is often, well, a common choice for investors looking to profit from a potential rise in value over time.

Preferred: Preferred shares do not give investors ownership in a company, so don't come with voting rights. Preferreds have characteristics of both common stocks and fixed-income investments, such as bonds. Similar to bonds, preferred shareholders receive fixed dividends, akin to a bond's coupon rate or interest payment. Similar to common shares, preferred shares can be structured to not pay out dividends.

The price of preferred stock can change with interest-rate movements and market confidence in the company's ability to pay the dividend.

If a company goes bankrupt or liquidates all its assets, preferred shareholders have a higher claim on the assets and earnings than investors with common shares.

Different types of preferred shares have different attributes, so investors should consult the shares' prospectus — a legal document that is usually available on the company's website — to review all the unique features.

Stock Exchanges

Stocks are typically bought and sold using electronic transactions on a stock exchange. In Canada, the Toronto Stock Exchange (TSX) is the largest exchange, while smaller, less-established companies generally trade on the TSX Venture Exchange. Derivatives, such as options and futures contracts, trade on the Montreal Exchange. In the U.S., the New York Stock Exchange (NYSE) and the NASDAQ are the largest stock exchanges.

Equities are not always traded on a traditional exchange. Some are traded over the counter, referred to as the OTC market. Companies will often trade OTC if they are not able to meet the strict listing requirements of the big exchanges.

Company Fundamentals

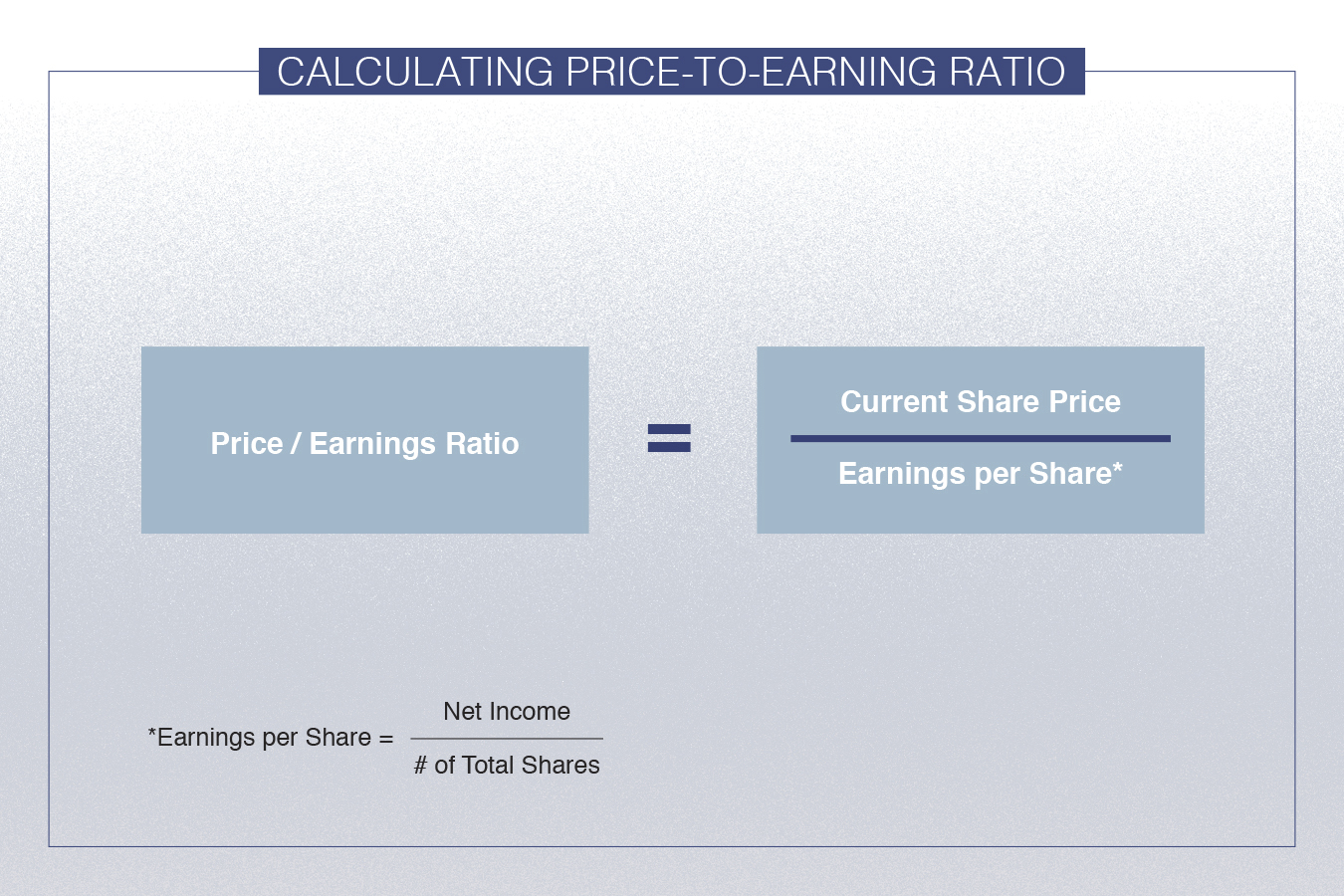

In the long run, stock prices are driven by how the market views a company's ability to generate earnings. This is why investors often pay attention to company fundamentals like earnings per share (EPS) and the price-to-earnings ratio (P/E).

These data points can help investors get a better idea of how well the company is growing its earnings. For example, earnings will go up if the company is able to sell its product for a higher price, sell more of its product or make the product at a lower cost.

How do shareholders make money from their investments? When the price of a share goes up, investors can choose to sell their stock for a profit. On the other hand, if an investor believes the stock price will continue to go up, they can choose to keep the stock in their portfolio.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2022.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently a resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.