What are Preferred Shares?

Written by The Content Team

Published on May 16, 2018

minute read

Share:

Q. What are preferred shares?

A. In short, preferred shares are considered a hybrid security because they offer a combination of equity and fixed-income features. Like stocks, preferreds have a share price and represent an ownership stake; like bonds, they can offer a steady stream of income, but in the form of fixed dividends. They're considered income investments, but technically are equities.

What does "preferred" mean?

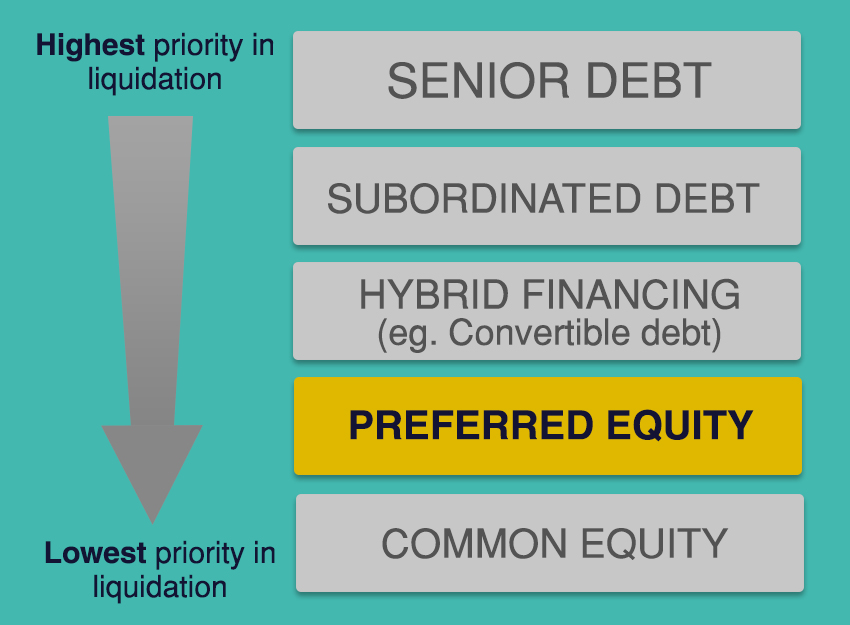

In the hierarchy of a company's issued capital, owners of preferred shares rank above owners of common shares when it comes to a company's assets and earnings. So if a company were to declare bankruptcy, for example, preferred shareholders would be paid before owners of the company's common stock, although not before the company's creditors.

How do you invest in preferred shares?

Like equities, company preferred shares are traded on major exchanges and are generally identified by a "PR" somewhere in the ticker symbol extension. They're also available in pooled funds like mutual funds and exchange-traded funds.

What are the different types of preferred shares?

There are a number of types, each offering different attributes that can be researched in the prospectus for a particular preferred-share issue. The four main types include:

Perpetual: These have no fixed term date and pay dividends in perpetuity as long as the company is capable of doing so. With its long duration (no maturity date), prices can be sensitive to interest rate movements.

Rate-Reset: These pay a set dividend rate for a period of time (typically five years), after which they would reset based on current interest rates if not repurchased (or called) by the issuer. When interest rates drop, so does the principal value of these preferreds.

Floating Rate: Dividend payments "float," or are reset periodically to reflect changing interest rates.

Convertible: This is an option that allows shareholders to convert their preferred shares into another series of preferred shares or common shares after a set date.

What are some other things to keep in mind if you're considering investing in preferreds?

- Income Protection — Companies can change their dividend payout policy for owners of common shares, including ceasing to pay any at all. Owners of preferred shares are more likely to continue to get a stated fixed dividend.

- Tax Considerations — Preferred shares are eligible for the dividend tax credit.

- Preferred shares don't have voting rights (unlike common shares).

- Capital Gains — Preferred shares tend to have less capital appreciation potential than common equity.

- Credit Quality — Like fixed-income investments, preferred shares receive credit quality ratings from agencies such as DBRS and Moody's.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2018. All rights reserved.

The views and opinions expressed in this publication are for your general interest and do not necessarily reflect the views and opinions of RBC Direct Investing. Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing website.

Explore More

5 Ways to Get More Out of Your RESP

How can you make the most of this investment vehicle? We explain.

minute read

There's an ETF for That!

Find out more about the options that are out there

minute read

ETF Trends from the RBC Capital Markets Trading Floor – May 2025

Here’s what we saw on the trading floor in May 2025

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.