Stocks: Understanding the Risk-Return Relationship

Published on May 6, 2019

minute read

Share:

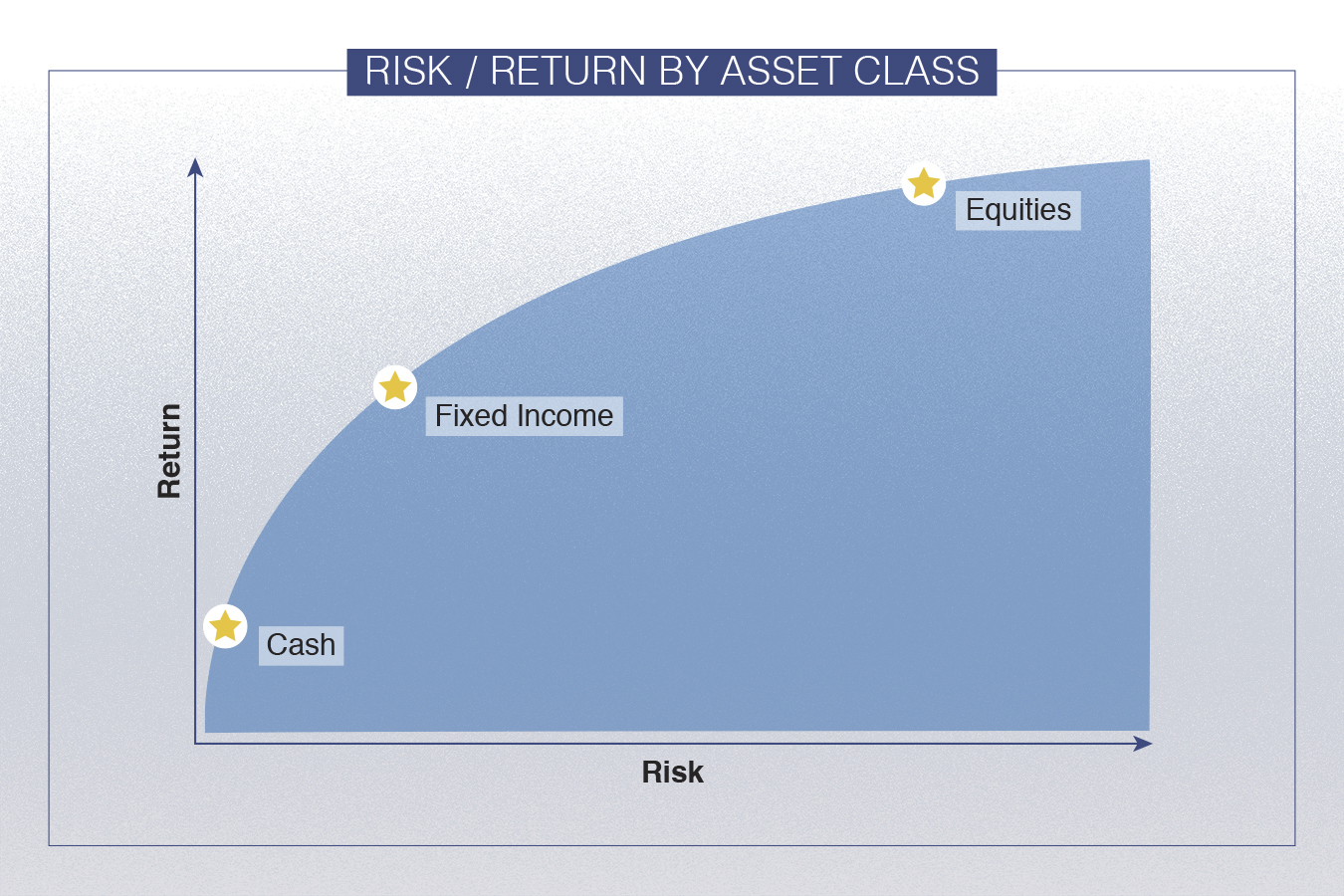

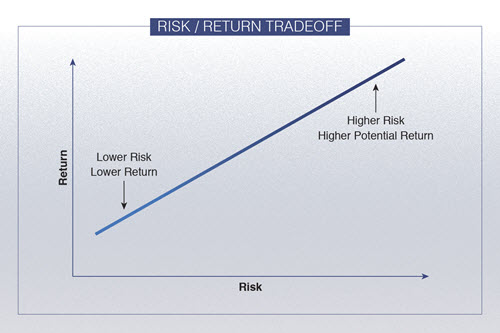

Investing in equities comes with more risk than investing in cash or bonds. However, equities also have the potential to produce higher returns. Understanding the risks that come with your investments can help you feel more confident in your decisions.

Here are seven risks to be mindful of when investing in equities.

1. Volatility

Stock markets can be volatile and investors often face unpredictable ups and downs. When a stock price moves quickly and by a significant amount, that volatility can have a big impact on a portfolio. Diversification may help to lower the risk that comes with owning just one company or sector.

2. Concentration

Investing in a small number of stocks means that if anything goes wrong with one of the companies, your overall portfolio is at risk. The likelihood of an individual company suffering damage is greater than the likelihood the entire market will collapse.

Investing in a mix of stocks increases diversification and can help reduce the risks associated with individual companies. This can be achieved by investing in different-sized companies in various countries, sectors and industries.

3. Liquidity

Liquidity measures how easy it is to buy and sell an investment. If there aren't many buyers for the stock you own, you may have trouble selling it. Stocks with low trading volume can be harder to sell and pose a risk because you may not be able to sell an investment when the time is right for you.

4. Foreign-exchange risk

Canadian investors that hold foreign investments face the risk of fluctuating exchange rates. When you are buying or selling a stock in a foreign currency, a change in the exchange rate can affect your performance returns. A declining Canadian dollar may add to foreign investment returns, while a strong Canadian dollar may hurt returns on foreign investments, particularly the U.S. Good to know? Your time horizon matters here. Many studies show changes in foreign currency exchange rates tend to have a smaller impact on performance returns over the long-term than over the short-term.

5. Geopolitical risk

The political stability and financial strength of countries around the world can affect stock prices. Issues such as politics, new legislation, financial regulations, tax policy and trade wars can cause market volatility in both developed and emerging markets. The issues may impact the country where a company is headquartered or countries where it does business.

6. Margin

Buying stocks on margin means you borrow money from RBC Direct Investing, securing the loan with your investments. Using margin tends to magnify portfolio volatility and can cause additional risk associated with interest rates. For example, if interest rates rise, the cost of borrowing rises, which makes it harder to produce positive returns on your investments.

7. Interest-Rate Risk

Rising interest rates may create headwinds for equities in a few ways. For example, higher rates can mean higher borrowing costs for companies. This could affect their return on capital. Find out more in How Rising Interest Rates Affect Investors.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2022.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently a resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.