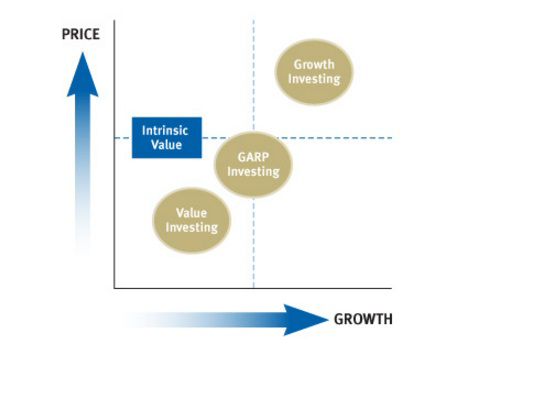

If you've read through the Growth and Value investing article and find your own style is somewhere in between, then maybe GARP is the right approach for you.

GARP stands for "growth at a reasonable price" and is really a combination of value and growth investing. GARP investors are looking for a stock that is trading for slightly less than its estimated value that also has earnings growth potential.

GARP investors do not necessarily stick to specific ratios or valuation metrics to help them select stocks. That being said, GARP investors usually do follow price/earnings (P/E = current share price/earnings per share) valuations in order to find investments that have been slightly discounted by the market

For instance, if ABC Co., is currently trading at $20 and its forecast earnings per share is $1.25, the stock is trading at 16x its earnings. Depending on the industry, this P/E ratio could be high or low. A GARP investor would compare ABC’s multiple to the multiples of other companies operating in the same industry. Typically, a P/E ratio in the 10x-20x range is reasonable for a GARP investor. Higher P/E multiples tend to indicate that the business is overvalued.

Because a GARP strategy is a hybrid solution for growth and value stock-picking, a GARP investor will experience a combination of returns.

GARP investors also look for low price/book ratios (P/B = current share price/book value per share) and a PEG ratio of less than 1 (PEG = P/E ratio/projected growth in earnings).

Because a GARP strategy is a hybrid solution for growth and value stock-picking, a GARP investor will experience a combination of returns. For instance, a value investor will do better when markets are falling, while a growth investor will do best as markets rise. A GARP investor will be somewhere in the middle.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® /

™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2017. All rights reserved.