Build Your Investment Plan

Published on May 3, 2019

minute read

Share:

Define Your Goals: What are You Saving For?

The first step in putting together your investment plan and determining your strategy is figuring out why you're saving in the first place.

You might have a short-term goal, such as a down payment for a home or a deposit on a new car. Longer-term goals might include retirement or a child's education.

Being able to state your goals clearly is an important step toward achieving them. Setting goals helps you take control of your financial life and can keep you motivated as you move closer to whatever it is you're saving for.

Investors come in all shapes and sizes — and your investing goals and strategies are likely to change over time. Life events, career shifts and, of course, how much time you have to achieve your financial goals all play a part. Nothing is carved in stone, so even if you set goals to get you started, you can always revisit them to make sure they still make sense.

What Kind of Investor Are You?

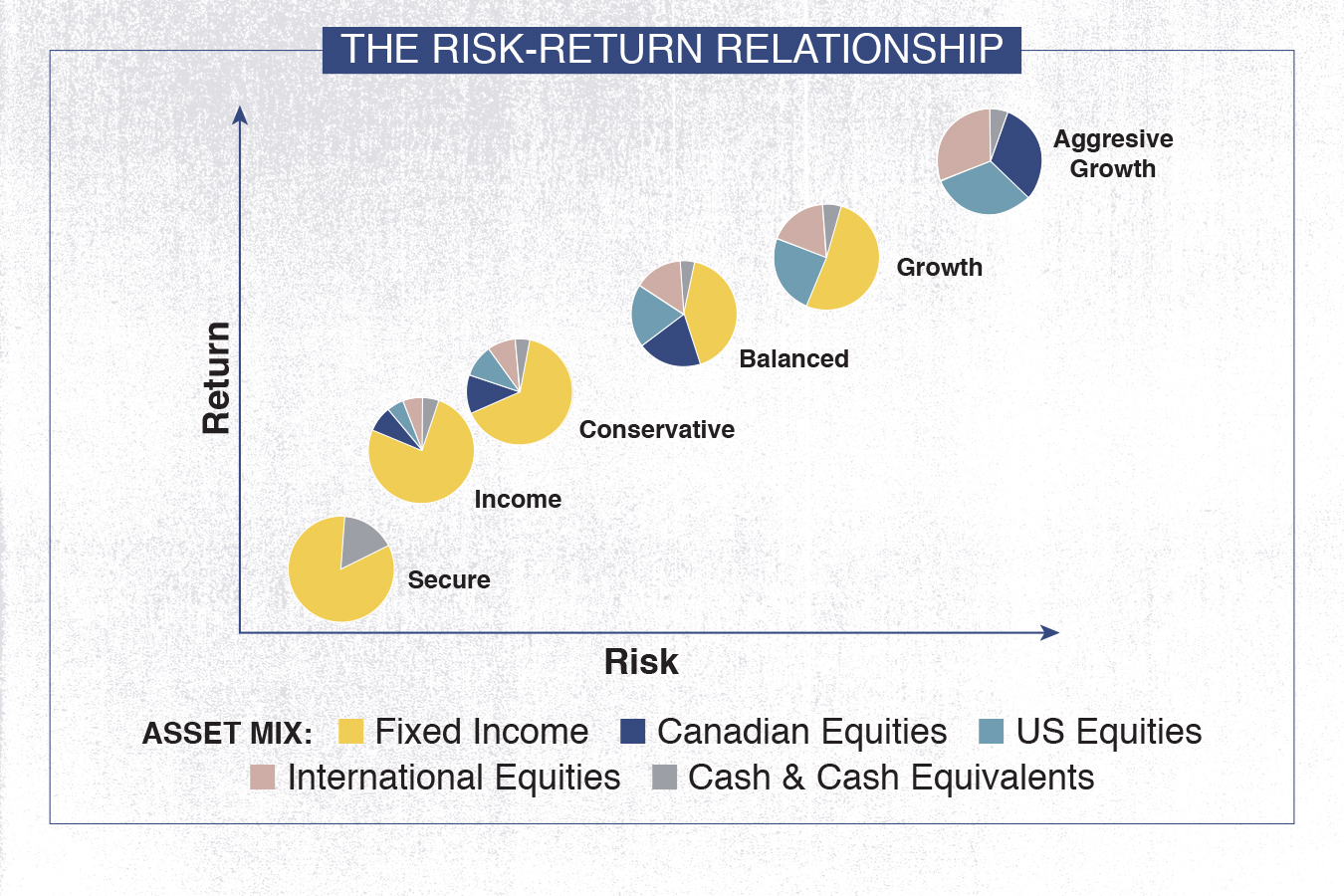

Your investor profile is determined by the level of risk you are willing and able to take to potentially earn higher returns. Typically, the higher the potential return of an investment, the higher the risk.

The graph above shows the relationship between investment risk and potential returns, as well as suitable asset mixes for different types of investors.

For example, an appropriate asset mix for a Secure is mainly fixed-income securities (low risk, low return). In contrast, the portfolio for an Aggressive Growth profile holds mainly equities (high risk, higher possible returns).

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2019. All rights reserved.

The views and opinions expressed in this publication are for your general interest and do not necessarily reflect the views and opinions of RBC Direct Investing. Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing website.

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.