Stock Dividends

Recall from the primer Dividends, Dates and Terminology, that a company can choose to make cash dividends1 out of its earnings, as a way of transferring value to shareholders. For various reasons, though, if a company would rather hang on to its cash, it may decide to distribute more shares of stock rather than pay out a cash dividend.

Like a cash dividend, a stock dividend does not change the value of a company – rather, as the number of a company’s shares outstanding increases, the stock’s price per share reduces by a similar amount.

A stock’s price = a firm’s market cap (or total dollar market value)/shares outstanding.

Let’s assume the following:

Company ABC has a market cap of $800 million and 150 million shares outstanding.

- Applying the formula above, the stock price is $5.33 (800/150).

To demonstrate how a 10% stock dividend would affect company ABC’s share price:

Each shareholder would receive 10% additional shares, which would increase the outstanding shares from 150 to 165 million.

- Applying the same formula, the stock price is now $4.85 (800/165).

The increase in the number of shares has effectively diluted the share price from $5.33 to $4.85, but as a shareholder you’d have received more shares.

Stock dividends offer choice for shareholders, as you can keep the newly distributed shares with the hope they grow in value or sell the shares to essentially create your own cash dividend.

Looking Beyond the Dividend Yield

It's important to keep in mind that a high dividend yield alone does not make a stock a great investment. A drop in the share price can make a yield more compelling, but looking beyond yield to assess corporate fundamentals can make sense.

A company in financial distress, for instance, may reduce or cease to pay dividends. To help determine a company’s financial health, here are some questions that may be worth considering:

- Does the company have a consistent history of earnings and earnings growth?

- Does the company have reasonably low debt and high and growing free cash flow?

- Is its current dividend sustainable, or is the company paying out too much of its profits as dividends?

- Does the company have potential to grow over time or will its current dividend limit future growth opportunities? What is most important to you?

The Dividend Payout Ratio

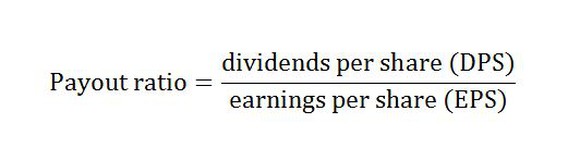

The dividend payout ratio is the percentage of earnings that a company pays out to shareholders. It's often used to measure the sustainability of a company's dividend payments and is especially useful when comparing it to other companies within the same industry.

Applying the Dividend Payout Ratio:

- Company XYZ has earnings per share of $3

- XYZ pays a dividend per share of $1.

- Company XYZ’s dividend payout ratio would be 33% (1/3).

What the Dividend Payout Ratio Can Tell Us

The payout ratio can help determine whether a company’s current yield can be maintained or increased over time. Generally speaking, lower payout ratios are preferred over higher payout ratios as the extra buffer provides some comfort that the current dividend will continue to be paid, even if there’s a drop in earnings.

Payouts at 55% or less may be considered lower risk and have the potential to increase their dividend payments over time.

- A lower payout ratio indicates that a company is retaining more of its earnings and putting it back to work in the business (often a newer company - valued by growth investors).

- A higher payout ratio indicates that a company is sharing more of its earnings with shareholders and retaining less cash in the business, which may impact future growth (often an older, established company - valued by income investors or those looking for an income stream).

- Beware a high payout ratio. High to very high payout ratios ranging between 55% and 95% might bear further scrutiny. If a company's dividend payments are proportionately higher that what it earns, the dividend may be at risk of being cut or eliminated. Payout ratios over 100% are a red flag.

- Example: If a company paying an annual dividend of $0.96 a year, only earned $0.86 per share over the past year, a payout ratio of 112% might indicate that the dividend is not sustainable.

If the stock has a high payout ratio compared to its industry peers and other potential warnings exist such as declining earnings, rapidly growing debt and/or a history of dividend cuts, there's a higher likelihood that the dividend could be in jeopardy.

A Note on Tax

- Dividends from Canadian corporations: Most dividend payments (other than capital dividends) are considered investment income but the distributions qualify for the dividend tax credit, which may reduce your total tax bill. The precise effect will vary according to your overall income, province of residence and the type of dividend you receive.

- Dividends from foreign corporations:Dividend payments from non-Canadian corporations are subject to different tax treatment. They are fully taxable at your marginal rate and do not qualify for the dividend tax credit. In most cases there will also be withholding taxes paid to the foreign country, with the amount depending on the country, the type of investment product and type of account holding the shares. A foreign tax credit may apply in some cases but it’s best to consult with a tax professional to discuss your individual tax circumstances.

When it comes to income, holding investments with less favourable tax treatment (ie. fixed income products) within your TFSA, RRSP or RRIF allows them to grow in a tax-deferred environment.

Meanwhile, holding stocks and equity products (mutual funds and ETFs) in your non-registered accounts allows you to fully benefit from the Canadian dividend tax credit and the preferential tax treatment for capital gains.

Note. When receiving dividends from U.S. stocks within a TFSA or RESP, a 15% withholding tax is applied by the Internal Revenue Service (IRS) to each dividend payment. The Canada-U.S. treaty only recognizes RRSPs and RRIFs as tax-deferred vehicles so if U.S. dividends are received in these accounts, there is no withholding tax.

Your portfolio should be structured to meet your future needs and involve decisions based on your time horizon, liquidity needs and risk tolerance. Check in with your Investor Profile to see where you fit. Within that framework, learning about investment products, account types and the tax treatment of certain investments can help you reach your financial goals down the road.

The information provided in this article is for general purposes only and does not constitute personal financial or tax advice. Please consult with your own professional advisor to discuss your specific financial and tax needs.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2018. All rights reserved.

There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Please read the prospectus or Fund Facts before investing. Mutual funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer, their values change frequently and past performance may not be repeated. For money market funds there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you.

1Dividends earned pursuant to DRIP may be subject to requirements imposed by the Income Tax Act (Canada).