A dividend1 is a cash distribution that is paid out from a company’s earnings when a company chooses to transfer value to shareholders rather than reinvesting cash back into the business. Holding a dividend-paying stock can be a way of providing you with regular income (usually quarterly) while allowing for potential growth of your investment.

Here we cover some common terms around dividends and what they mean:

Declaration Date

This is the date that a company announces it is paying a dividend. A declaration statement is issued which includes details such as the size of dividend, the record date and the payment date.

Ex-Dividend Date (or Ex-Date)

In order to receive the next scheduled dividend, you must own the stock before this date.

If the stock is purchased on or after the ex-dividend date, the seller of the stock keeps the dividend.

Record Date (or Date of Record)

This is the date that you must be on the company’s books as a shareholder of record to receive the dividend.

Payment Date

This is the scheduled date on which a company will pay a declared dividend to shareholders of record.

Hypothetical Example – Company ABC

On August 15, 2017, Company ABC declares a dividend payable on September 28, 2017 to its shareholders. Details stipulate that shareholders of record on the company's books on or before September 6, 2017 are entitled to the dividend. The stock would go ex-dividend one business day before the record date.

The table below puts it together with the key dates:

Dividend Yield

This is the percentage of return a company pays out annually in dividends relative to its share price. Not all companies pay a dividend, so the presence of a dividend yield on a stock quote screen can often be viewed positively - as only profitable companies tend to share their earnings.

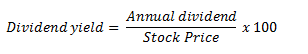

A stock’s dividend yield is calculated by taking its annual dividend-per-share and then dividing it by the stock's current price. The result is then expressed as a percentage.

The formula is:

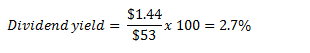

As an example, Company ABC pays an annual dividend of $1.44, and the stock is trading at a price of $53.00. Company ABC’s dividend yield is:

It's important to realize that a stock's dividend yield is not guaranteed. It can vary in response to market fluctuations and is paid only when a company chooses to.

Fast Fact about Performance

Dividends are one component of a stock's total return. The other is the change in the share price over a period of time. For example, if a stock's price increased 5% in the year and it paid a 3% dividend yield, your total return would be 8% if you held the stock the entire year.

On the flip side, if you were holding a dividend-paying stock and the price declined 5% in the year, you’ve still earned 3% through dividends, so your total return would be -2%.

If you're investing for the long term, it’s worthwhile keeping the two parts of a stock's total return in mind. The simple equation is below.

Dividend Reinvestment Plan (DRIP)

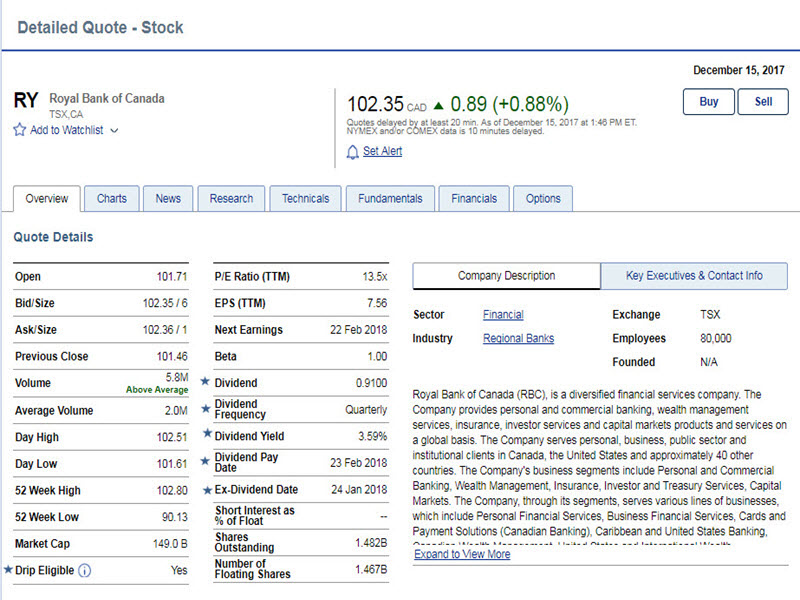

A Dividend Reinvestment Plan automatically reinvests dividends into additional shares2, which can be handy if you are receiving small amounts of cash. Look for ‘DRIP eligible’ under Quote Details on the Detailed Quote page (see excerpt below).

Sellers and Ex-Dates

If you are selling a stock with a dividend reinvestment plan (DRIP) in place, the ex-dividend date is important to consider. If you intend to sell an entire holding of a stock but sell it on or after the ex-dividend date, you could end up holding a few residual shares you didn’t count on.

To check out dividend information on your stocks, enter a stock name or symbol into the search feature at the top right of any screen on the site. Select a stock and you will be directed to the Detailed Quote page like the one below. Here, we’ve highlighted some key information:

A high dividend yield alone does not measure up to a great investment, so it may be prudent to dig a little deeper. If you’d like to learn more about dividends including risk, types, and some handy ratios, keep reading.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2017. All rights reserved.

1Dividends earned pursuant to DRIP may be subject to requirements imposed by the Income Tax Act (Canada). It is your responsibility to ensure that any associated tax requirements or obligations are satisfied.

2The list of DRIP eligible securities is subject to change at any time without prior notice. RBC Direct Investing will purchase whole shares only. Some exclusions may apply. Some eligible securities such as preferred shares and voting class common shares will not reinvest into additional units of the same security but rather the underlying non-voting common share or similar security.

Images are for illustrative purposes only.