Trading On Mobile: 3 Things to Know

Written by The Content Team

Published on May 25, 2020

minute read

Share:

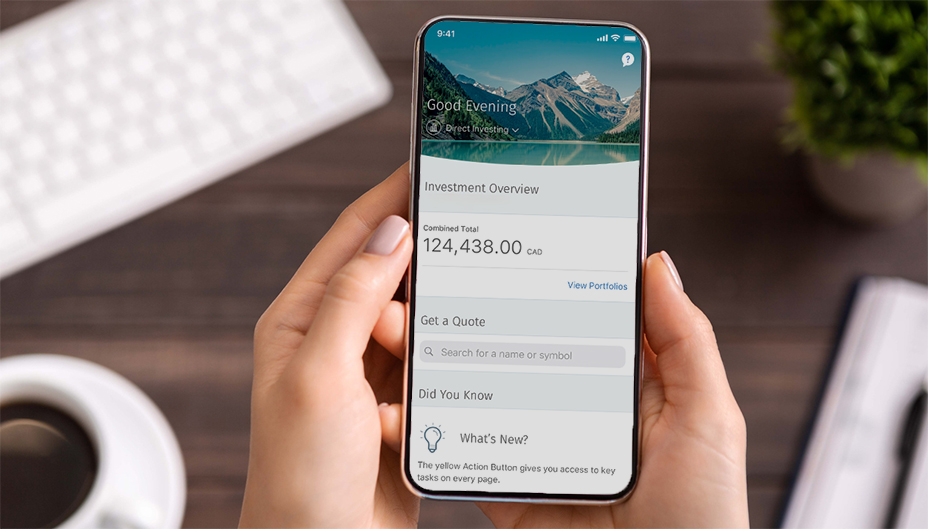

Mobile trading just got a whole lot easier. With the new RBC Direct Investing mobile experience, you can now do more than ever before. Here are just three things you can do on your mobile app to stay in control of your investments.

Act quickly

Thanks to an action button on every screen, it's easy to navigate and trade effortlessly – which means quick access to place an order, transfer funds or view your order status.

Check in at your convenience

With what you need at your fingertips, you can stay on top of what's happening in the markets using your recent searches, detailed stock quotes and interactive price charts. Plus, with just one tap you can add stocks or other investments of interest to your personal watchlists.

See the big picture

When you sign in, on your app homepage, you can see all of your investments, switch between accounts and manage your watchlists. Plus, from the Portfolio page, you can check out the holding details for each of your investment accounts.

The new RBC Direct Investing Mobile Experience is available through the RBC Mobile1 app, which can be downloaded or upgraded in the Google Play† and App Store. You can also text "RBC" to 722722 to receive a link to download.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2020. All rights reserved.

1RBC Mobile is operated by Royal Bank of Canada, RBC Direct Investing Inc. and RBC Dominion Securities Inc.

iPhone and iPod touch are trademarks of Apple Inc., registered in the U.S and other countries. App Store is a trademark of Apple Inc.

†Android is a trademark of Google LLC

†Google Play and Google Play logo are trademarks of Google LLC.

The views and opinions expressed in this publication are for your general interest and do not necessarily reflect the views and opinions of RBC Direct Investing. Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing website.

Explore More

Here’s What Every Canadian Should Know About Estate Planning

Insights from Leanne Kaufman to help you feel more confident as you plan

minute read

3 Things We're Watching This Week

What the Inspired Investor team is watching

minute read

What’s Driving the Recent Surge in Gold Prices

Here are some things to watch with the gold market

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.