Types of Options: Calls and Puts Explained

Published on May 6, 2019

minute read

Share:

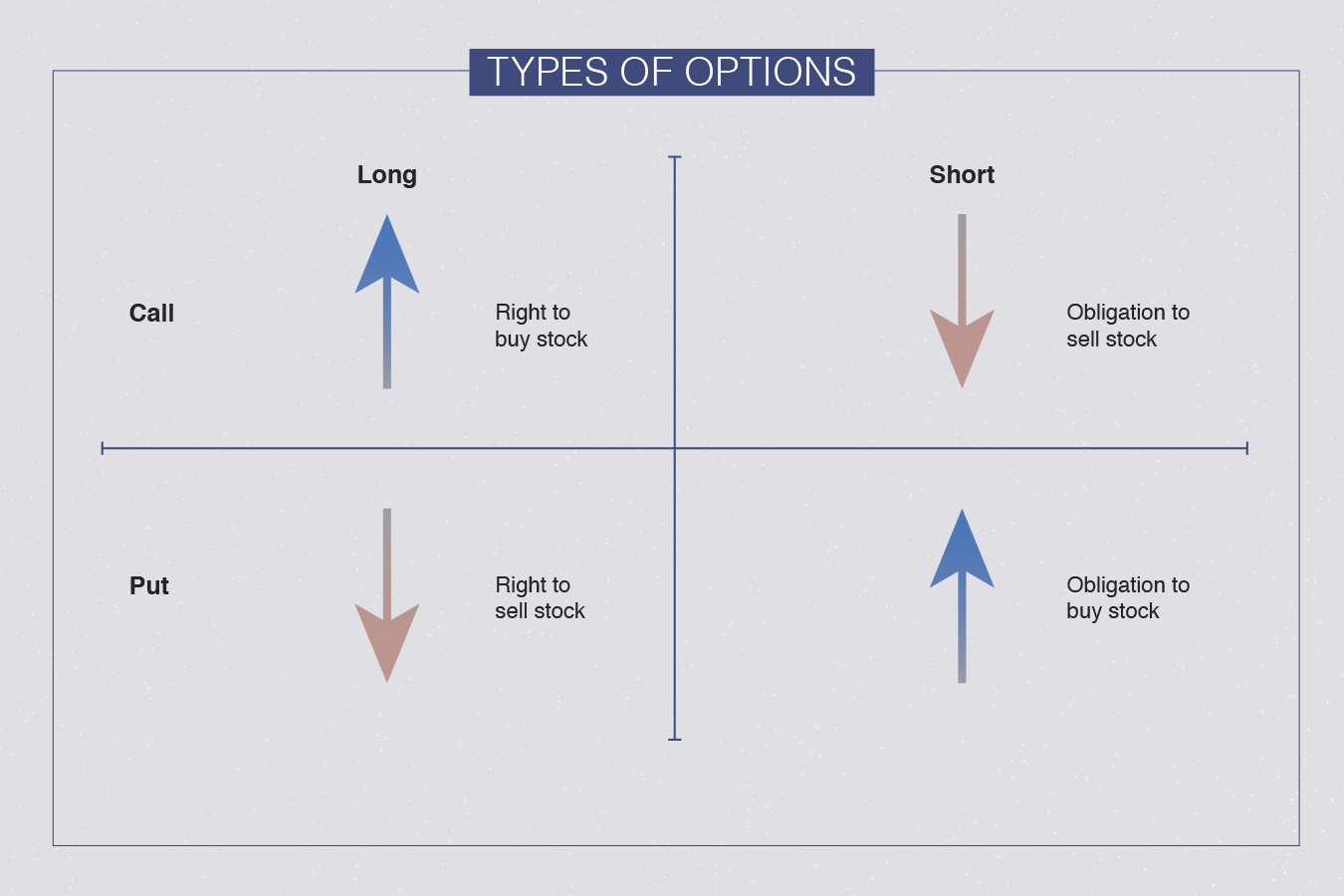

There are two main classes of options: calls and puts. To explain these, let's focus on stocks and get into some strategies with the examples below.

Call options

Buyer: When you buy a call option, you pay a premium to have the right — without being obligated — to buy the underlying stock at a predetermined price (the strike price) on or before a set expiry date.

You might buy a call if you think a stock's price is going to rise and you want to profit from that move without having to buy the stock itself. How? If the stock price does rise, you could sell the option contract at a profit. Or, if the stock moves above the strike price, you could buy the stock for cheaper than the market price.

Seller: When you sell, or "write," a call option, you receive a premium, but you become obligated to sell the underlying stock at a predetermined price on or before the expiry date should you be assigned. Being assigned means the option has been exercised and you need to fulfill your obligation to sell.

You might sell a call on a stock that you own (a common strategy known as covered call writing) to potentially earn a little income and extra return on your stock position.

Put options

Buyer: When you buy a put option, you pay a premium to have the right — without being obligated — to sell the underlying stock at a predetermined price (strike price) on or before a set expiry date.

You might buy a put if you think a stock's price is going to fall and you want to profit from the change in price.

If you own the stock, a put option (known as a protective put) can help to protect against a decline in the share price while still allowing you to benefit from limited capital appreciation if the stock increases in value.

Seller: When you write a put option, you receive a premium but you also become obligated to buy the underlying stock at a predetermined price on or before the expiry date should you be assigned.

Since options are complex investments that may include high-risk, advanced trading strategies, it’s important to fully understand the risks associated with options before you begin trading them in your portfolio. It's equally important to closely monitor your investments and understand how much risk you're taking on at any given time. Use a Practice account to try options trading, risk-free!

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2019. All rights reserved.

The views and opinions expressed in this publication are for your general interest and do not necessarily reflect the views and opinions of RBC Direct Investing. Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing website.

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.