Options Trading Strategies

Published on May 6, 2019

minute read

Share:

In this section, we'll explore three options strategies that investors often turn to, depending on their portfolio needs and what they think is going to happen to a particular stock's price.

Options contracts have a limited shelf life, usually trading over short periods like 30, 60 or 90 days, so keep in mind your strategy may have just a short time to work.

Let's look at some common options scenarios to explain further.

Please note: Commission costs are not included in the examples.

Call Options

Let's decode a call option example. When looking for a call option on a stock, you might see something like this:

ABC 031519 10 C

Which means…

ABC = the stock symbol

031519 = the expiry date of March 15, 2019

10 = the $10 strike price at which the option contract could be exercised

C = Call

The Set Up:

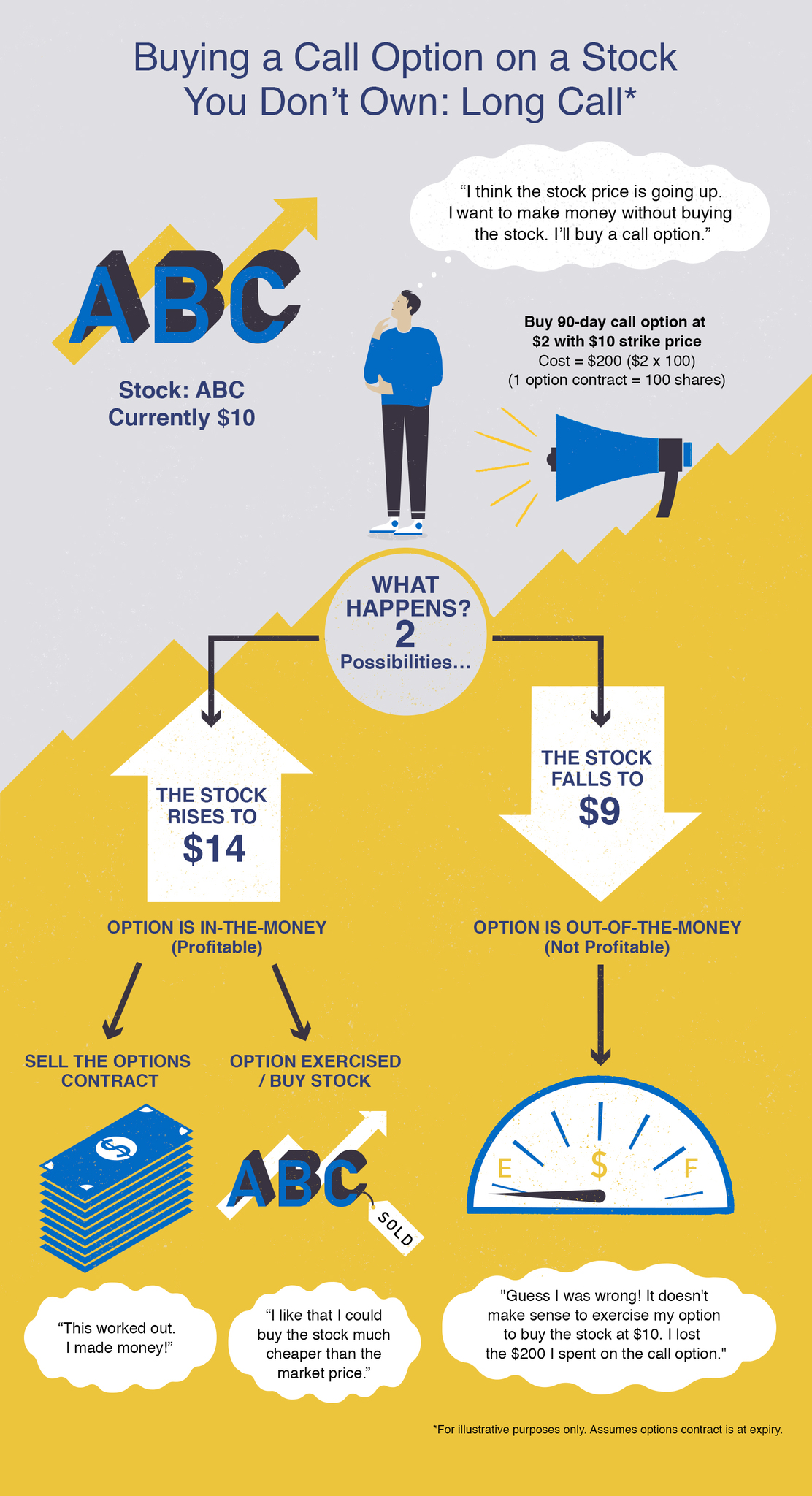

Let's say company ABC is trading at $10 a share. You believe the share price is going to increase in the near term, but don't necessarily want to buy the stock. You could buy a call option. Typically, options cost a fraction of the cost of the actual stock.

Strategy: Buy a call option

You decide to buy one call option contract on company ABC with a strike price of $10. It expires in 90 days. (1 option contract = 100 ABC shares)

The call option costs $2 (also known as the premium) for one contract. That means you pay $200 ($2 premium x 1 contract x 100 shares). You now have the right to buy 100 ABC shares at $10 until the option contract expires — regardless of the stock's actual price.

Here's what that would look like:

Outcome Possibilities:

- As you anticipated, the stock price rises — in this case to $14. As a call option holder, you could sell your contract for a profit (the contract is $4 in-the-money since the stock is above the $10 strike price). Or, you could choose to exercise your option and buy the underlying stock at $10. Your cost per share would be $12 (strike price of $10 + $2 premium already paid). Good for you! You'll basically acquire the stock at a $2 discount from its $14 market price.

- Instead of rising in value, the stock price falls — in this case to $9. This isn't what you wanted. As a call option holder, you wouldn't choose to exercise your option to buy the stock at $10, since its market price is now lower. If the option were to expire out-of-the-money, the contract would be worthless. Your maximum loss would be the $200 premium you paid to buy the options contract.

Put Options

Let's decode a protective put options strategy. When looking to buy a put option to protect a stock you own, you might see something like this:

ABC 031519 10 P

Which means…

ABC = the stock symbol

031519 = the expiry date of March 15, 2019

10 = the $10 strike price at which the contract could be exercised

P = Put

Set up:

Let's say company ABC is trading at $10 a share. You believe the stock price is going to fall in the near term. You hold the stock, but don't want to sell it. You could buy a put option, also called a protective put.

Strategy: Buy a put option

You decide to buy one put option contract on company ABC with a strike price of $10. It expires in 90 days. (1 option contract = 100 ABC shares)

The put option costs $2 (also known as the premium) for one contract. That means you pay $200 ($2 premium x 1 contract x 100 shares). You now have the right to sell 100 ABC shares at $10 until the option contract expires — regardless of the stock's actual price.

Here's what that would look like:

Outcome Possibilities:

- As you anticipated, the stock price declines — in this case to $6. As a put option holder, you could sell your contract for a profit (the contract is $4 in-the-money since the stock is less than the $10 strike price). Or, you could choose to exercise your option and sell the stock at $10, which is higher than the market price. Your net proceeds per share would be $8 (strike price of $10 – $2 premium already paid), which means you'd basically be selling the stock for $2 higher than its $6 market price.

- Instead of declining in value, the stock price rises — in this case to $11. As a put option holder, you wouldn't choose to exercise your option to sell the stock at $10 since you can make more money by selling in the market. If the option were to expire out-of-the-money, the contract would be worthless. Your maximum loss is the $200 premium you paid.

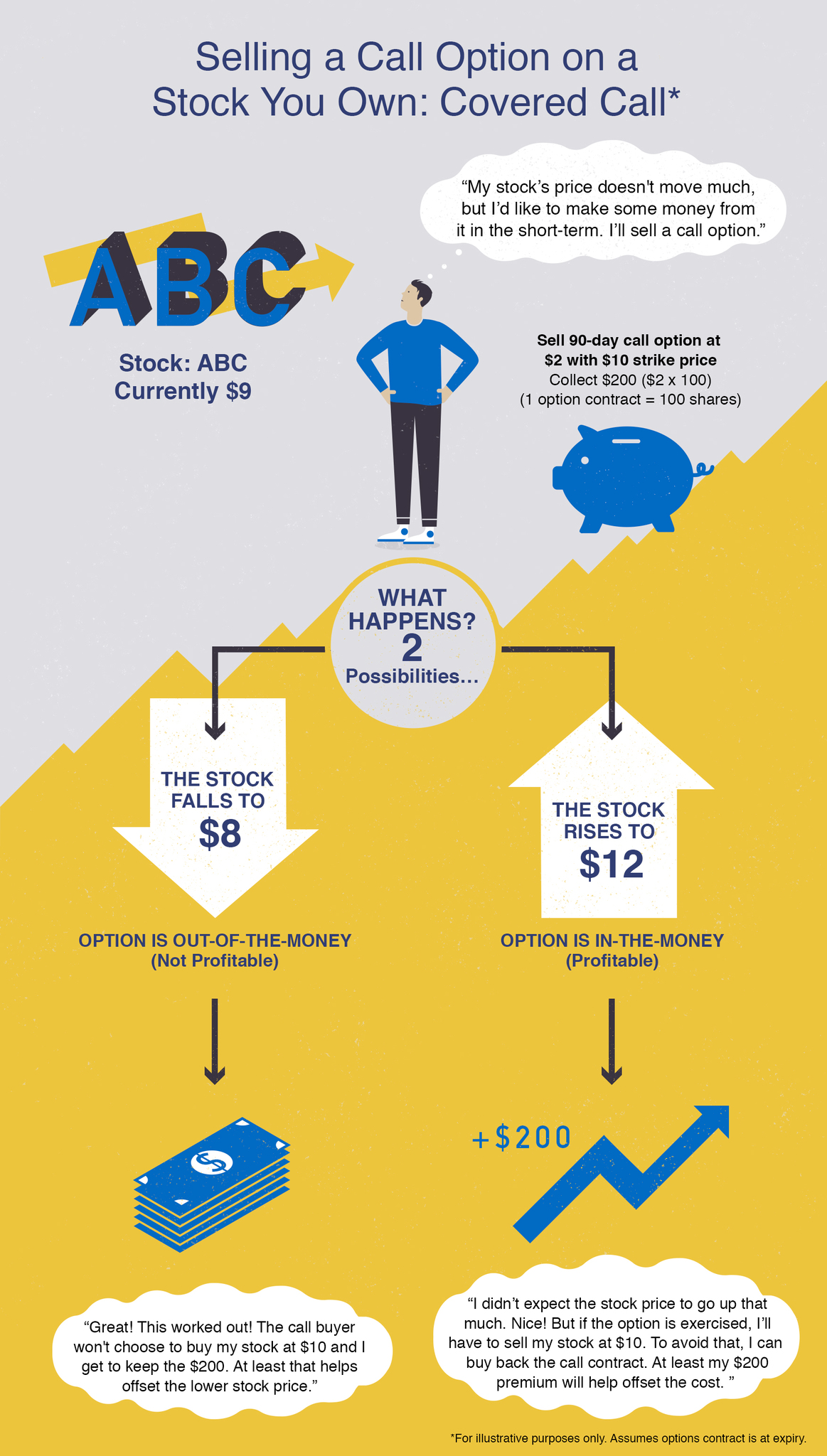

Covered Call

Let's decode covered calls. When looking for a call option to sell to generate income on a stock you own, you might see something like this:

ABC 031519 10 C

Which means…

ABC = the stock symbol

031519 = the expiry date of March 15, 2019

10 = the strike price at which the contract could be exercised

C = Call

Set up:

Let's say ABC stock is trading at $9 a share. You believe the price won't move much over the near term, but you'd like to make some income on it. You could sell (write) a covered call option.

Strategy: Sell a call option

You decide to sell one call option contract on company ABC with a strike price of $10. It expires in 90 days. (1 option contract = 100 ABC shares)

The call option premium is $2 per contract, so you'll collect $200 ($2 premium x 1 contract x 100 shares) for selling it. In return, if the contract is exercised by the buyer any time until the contract expires, you will be obligated to sell 100 ABC shares at $10 – regardless of the stock's actual price.

Here's what that would look like:

Outcome Possibilities:

- As you expected, the share price hasn't moved much, falling just slightly — in this case to $8. The option is out-of-the-money, but you keep the premium you received on the sale of the contract. The odds of assignment (when you become obligated to sell your shares because the buyer has exercised the option) are low, because the buyer likely wouldn't choose to buy the stock at $10 when it's just $8 in the market. Your profit on the option would be the $200 premium you received.

- Instead of the price staying flat, it rises — in this case to $12. The option is in the money. There is a high likelihood the call buyer will exercise and you'll be obligated to sell your shares. In this case, you wouldn't face a financial loss because of the premium you collected ($10 sale price + $2 premium collected = $12 market price). If the option is at expiry and in-the-money, you risk assignment. If you want to keep your stock, however, you could choose to close out your position, or buy back the contract, before the market close.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2019. All rights reserved.

The views and opinions expressed in this publication are for your general interest and do not necessarily reflect the views and opinions of RBC Direct Investing. Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing website.

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.