Many people could use some help when it comes to choosing an appropriate mix of investments (known as asset allocation or asset mix), to reach their goals. When thinking about a long term approach to investing, it’s helpful to know who you are as an investor. Take some time to know your investor profile.

As a next step in building a portfolio, you might consider consulting Asset Allocation Models that are designed to align to your investor profile. RBC Global Asset Management (GAM) sets asset mix benchmarks for each model with the objective of balancing risk and reward over time. GAM regularly reviews, and occasionally changes, regional exposures and the overall asset mix.

The models below focus on diversification and conveniently illustrate what an appropriate asset mix might look like for five different types of investors with various objectives. Use them to inform your investment choices or choose one that best aligns with your investor profile when building your own portfolio.

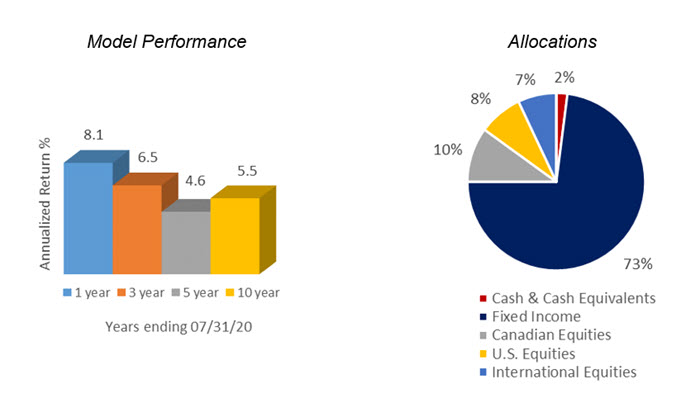

Very Conservative

This investor wants income with maximum capital preservation and the potential for modest capital growth. They should be comfortable with small fluctuations in the value of their investments and plan to hold their investment for the short to medium term, at least 1-5 years. They invest mostly in fixed-income securities and a small amount of equities, to generate income while providing some protection against inflation.

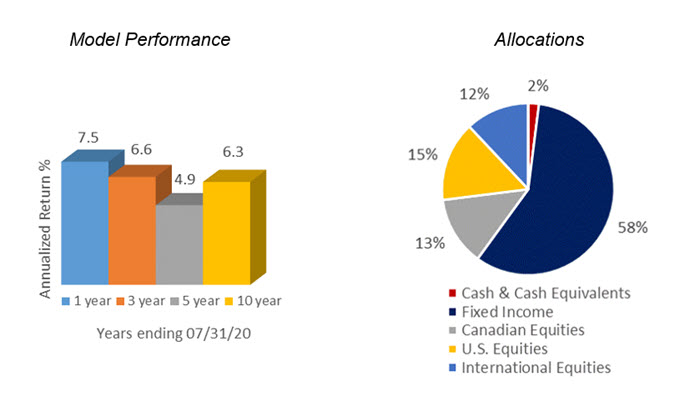

Conservative

This investor wants modest income and capital growth with reasonable capital preservation. They should be comfortable with moderate fluctuations in the value of their investments and plan to hold their investment over the medium to long term, at least 5-7 years. They invest mostly in fixed income securities, with some equities, to achieve more consistent performance and provide a reasonable amount of safety.

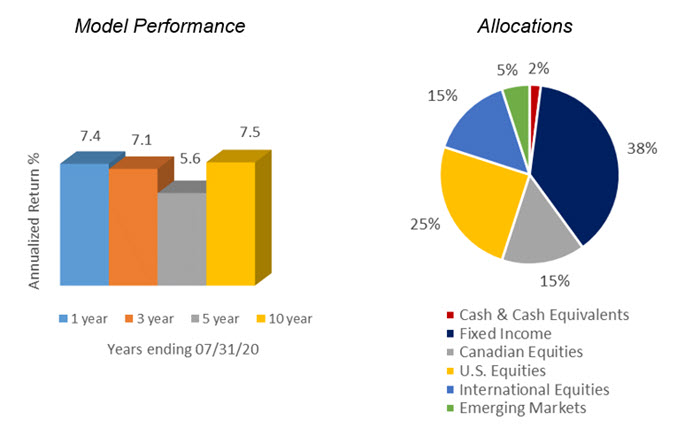

Balanced

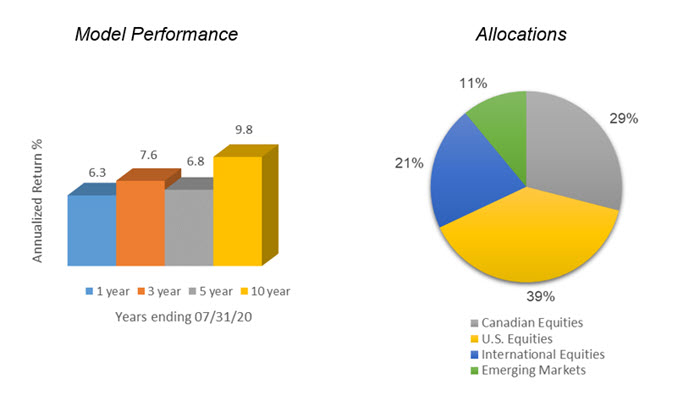

This investor wants a balance between long-term capital growth and capital preservation, with a secondary focus on modest income. They should be comfortable with moderate fluctuations in the value of their investments and plan to hold their investment over the medium to long term, at least 5-7 years. More than half their portfolio will usually be invested in a diversified mix of Canadian, U.S. and global equities.

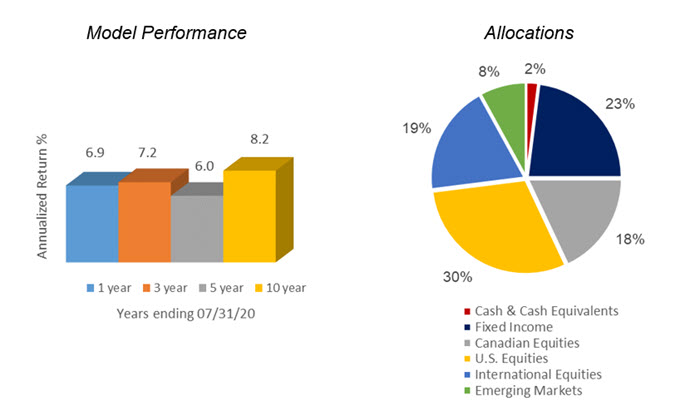

Growth

This investor wants long-term growth over capital preservation and regular income. They should be comfortable with considerable fluctuations in the value of their investments and plan to hold their investment for the long term, at least 7-10 years. They primarily hold a diversified mix of Canadian, U.S. and global equities.

Aggressive Growth

This investor wants maximum long-term growth over capital preservation and regular income. They should be comfortable with significant fluctuations in the value of their investments, have a high risk tolerance and plan to hold their investments for the long term, at least 7-10 years. They are almost entirely invested in stocks and emphasizes exposure to global equities.

To help you select the stocks, bonds, mutual funds and exchange-traded funds (ETFs) needed to build a portfolio like those above, we’ve included links to some popular investing tools below.

Tools to help

Why not start by researching the companies that create products and services that interest you? Choose from various criteria to find the stock that’s perfect for your investment needs.

Get inspired with new investment ideas by referencing Morningstar’s pick lists.

For more information on GAM's Asset Allocation Models please refer to the quarterly Global Investment Outlook on the Market Commentary page. Find it under Research on your site menu.

Model asset allocations have been prepared by RBC Global Asset Management Inc. (“RBC GAM”). The benchmark indexes that make up the asset allocation models are the FTSE Canada Canadian Treasury Bill 30 Day, FTSE Canada Universe Bond, S&P/TSX Composite TR, S&P500 CAD, MSCI EAFE NR CAD, MSCI EM GR CAD. Benchmarks are reviewed annually by RBC and may change without notice.

Performance data is based on annual compound total returns of the underlying asset classes and is gross of fees (does not take into account management fees, commissions, expenses or income taxes payable). Model performance assumes monthly rebalancing. Actual results may vary, perhaps to a large degree.

Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. It is important that you monitor and review your portfolio periodically. You remain solely responsible for your investment decisions and RBC Directing Investing or its affiliates are not responsible for any damages or losses that may arise from the use of this .

RBC Direct Investing Inc., RBC Global Asset Management Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2021. All rights reserved.