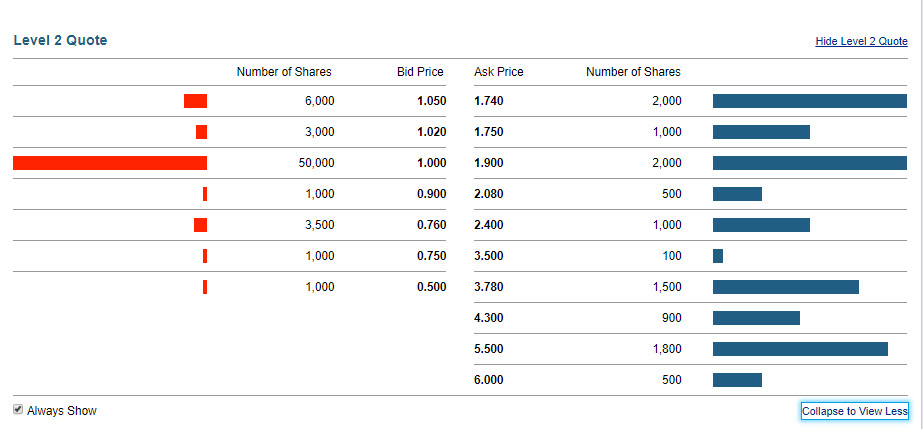

Wondering how Level 2 quotes1 might help you trade Canadian exchange-listed stocks and ETFs? Here is an overview of what a Level 2 quote looks like on your detailed quote page, and a couple of examples showing how you might use the information to make trading decisions.

For illustrative purposes only.

Trading Scenarios:

Suppose you wanted to sell 10,000 shares of a TSX listed stock that has relatively low daily trading volume and a wide spread between bid & ask.

Scenario 1> check at what prices you’d likely get filled at if you placed a market order

Looking at the Level 2 example above, you see bid/ask information showing the number of shares available at various prices. Since you are selling, you’ll look at the ‘bid’ information to see what buyers are willing to pay, and the quantity they are prepared to purchase at various price points. If you place a market order to sell all 10,000 shares, you can anticipate selling 6,000 at $1.05, 3,000 at $1.02 and 1,000 at $1.00. So the first advantage of Level 2 is greater price certainty when placing an order.

Scenario 2> ‘work’ your order to aim for a better price

Or maybe you are not in a rush, and you want to sell all of the shares at $1.05 or more. There’s only one order at that price, and it is for 6,000 shares. Using the information available on the Level 2 quote, you could place more than one order*.

- First order: Sell up to 6,000 shares at $1.05 immediately.

- Subsequent order(s): The Level 2 quote shows you there’s a buyer for 3,000 at $1.02 but it’s below your target price. Looking at the ‘ask’ you see that other sellers are looking for $1.74 or more per share. So rather than accept $1.02 for the next 3,000 shares, you could place a sell order between the bid ($1.02) and the ask ($1.74). Say you put in an order to sell a portion (or the rest) of your shares for sale at $1.50. Since your selling price is below the current $1.74 ask price, your price is now the lowest ‘ask’ and may attract a buyer.

*Keep in mind that placing multiple orders will result in additional commission costs, something to factor in when you’re working an order.

Where to find Level 2 quotes? On the RBC Direct Investing site, Level 2 quotes for Canadian exchange-listed (TSX or TSX/V) stocks and ETFs can be found on your detailed quote page. Pull up a quote and scroll down the page to find them.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® /

™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2020. All rights reserved.

1Level 2 quotes are available on stocks and ETFs that trade on the TSX and TSX-Venture exchanges for all clients. Level 2 quotes are also available on stocks and ETFs that trade on the Canadian Securities Exchange and Nasdaq for Active Trader clients upon accepting the terms and conditions of all exchange agreements on the RBC Direct Investing online investing site.