Fixed income products can play an important role in reducing your portfolio's volatility. Explore this and other key benefits.

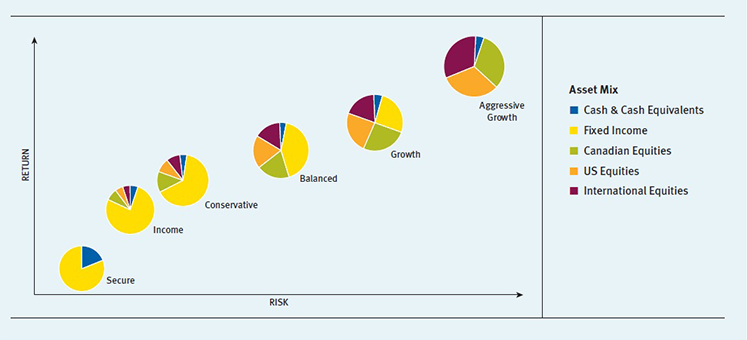

Historically, fixed income products such as bonds have provided a higher return than cash investments and exhibited less volatility than stocks. In times of equity market downturns, fixed income products may offset the negative returns on stocks while lowering the overall risk of your portfolio. The proportion of fixed income and equities in your portfolio will depend on your investor profile.

Fixed income products appeal to investors for a number of reasons:

- Income: Most bonds pay interest semi-annually; however, some bonds pay monthly, quarterly or even on an annual basis. These payments provide you with regular and predictable income. This regular income stream can also help to reduce the volatility of your portfolio’s returns and can be a source of liquidity for non-investment expenditures.

- Safety: High-quality bonds such as those issued by the Government of Canada bonds and many corporate bonds provide a high degree of safety. Although any bond can decline in value, you can feel confident that you will receive full repayment of principal plus interest if you hold high-quality bonds to maturity.

- Variety: Many kinds of fixed income products are available, from guaranteed investment certificates (GICs) and treasury bills to government and corporate bonds. You can also purchase strip bonds, real return bonds, step-up bonds, Eurobonds and many U.S. instruments.

- Convenience: You can purchase GICs, bonds and other fixed income investments online just as easily as you would stocks. You can also gain fixed income exposure through a variety of mutual funds and exchange-traded funds, also available online.

For more information read the Fixed Income Basics article.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® /

™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2017. All rights reserved.