Save Time and Costs with Dual Currency Investing

When you buy or sell an investment, you can choose in which currency (Canadian or U.S. dollars) you wish the trade to settle by simply selecting USD or CAD on your stock order entry. This feature is available for most account types, with the exception of RESPs.

Benefits and Uses

- Access to U.S. dollars - great for those trips south of the border. Access your U.S. dollars or perform your foreign exchange whenever it’s convenient for you

- Save money. When you buy a U.S. investment and hold it in U.S. dollars, you save on foreign exchange costs by not converting from one currency to another.

- Convenience. When you buy an investment and settle the trade in the same currency, you don’t have to remember to do the foreign exchange before settlement date.

- Flexibility. You can choose to buy in one currency where you might have a balance or sell in another to raise cash.

- Currency diversification. Having both Canadian and U.S. dollar assets can add diversification to your portfolio.

- Apples to apples performance. If you buy U.S. securities and settle in U.S. dollars, the performance of those investments is also reflected in U.S. dollars.

Buy Orders

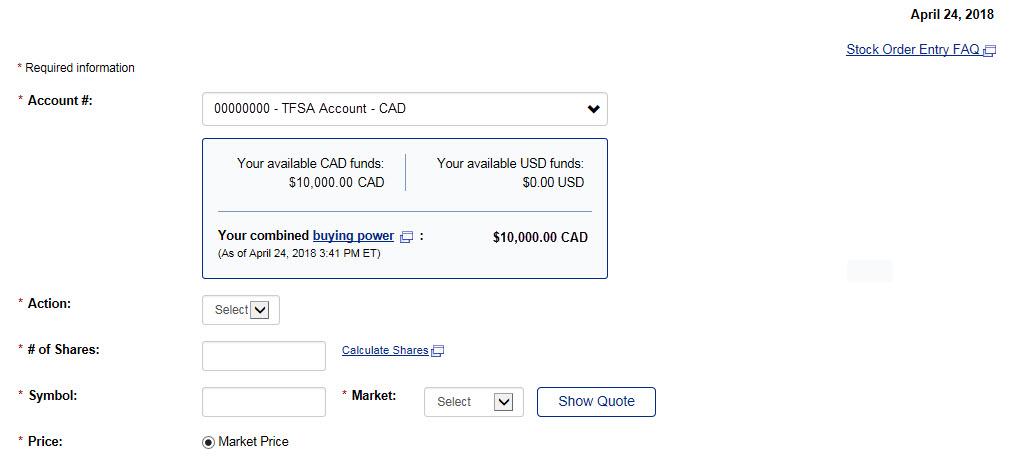

If you choose to purchase a stock in Canadian dollars, select the “CAD” account from the Account # drop-down menu, choose “Buy” in the Action field, enter the number of shares to purchase and the symbol of the security, and select “CDN” in the Market field (see example 1 below).

Example 1: Stock buy order placed in Canadian dollars (CAD)

For illustrative purposes only.

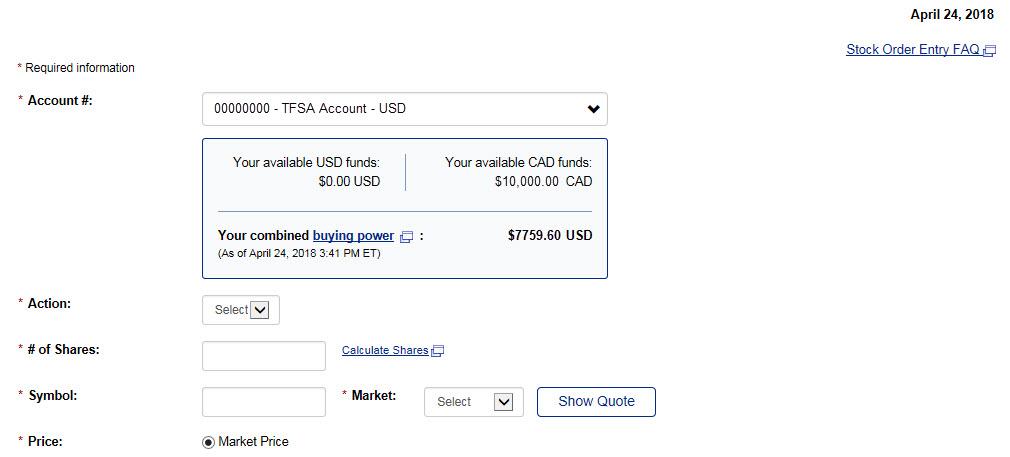

If you choose to purchase a stock in U.S. dollars, select “USD” from the Account # drop-down menu, choose “Buy” in the Action field, enter the number of shares to purchase and the symbol of the security, and select “US” in the Market field (see example 2 below).

Example 2: Stock buy order placed in U.S. dollars (USD)

For illustrative purposes only.

Sell Orders

When placing a sell order, you can also choose to settle your trade in either Canadian or U.S. dollars.

If you choose, for example, to receive U.S. dollars when selling a U.S.-dollar investment, simply select the “USD” account from the Account # drop-down menu and select “US” in the Market field.

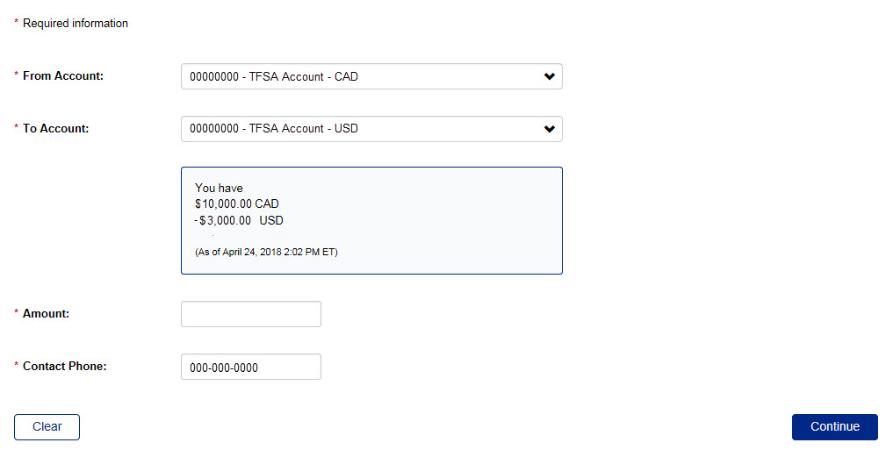

Debit Balances

Be mindful of currency settlements. Interest is charged and calculated separately for debit balances in each currency.

For illustrative purposes only.

In other words, interest owed on a negative cash balance in one currency will not be offset by a positive cash balance in the other currency within the same account.

This means that if you choose to buy an investment in one currency but you only have the cash in the other currency, you will need to convert the cash prior to settlement date to settle the trade.

Converting your Currency - Foreign Exchange

Perhaps you are not looking to buy or sell securities, but would rather convert some or all of your CAD cash into USD, or vice versa. To transfer cash between U.S. and Canadian currencies, perform your foreign exchange conversions by selecting the Transfer Cash on the Transfer Cash & Foreign Exchange page under My Portfolio. .

Note that your available funds to transfer for foreign exchange may be different from the cash balance shown on the Holdings page due to sell orders that have not settled. To confirm settlement dates on recent sell orders, visit the Activity History page under the Place an Order tab.

You should also note that foreign exchange requests processed during foreign exchange hours cannot be cancelled or reversed. Pending foreign exchange requests can be cancelled prior to transaction being processed. To cancel a pending foreign exchange request, go to the Transfer History tab on the Transfer Cash & Foreign Exchange page.

For more information and to find answers to popular questions, read Dual Currency FAQs.

Real time exchange rates are available during foreign exchange hours (approx. 7:45 a.m. to 4:45 p.m. EST on Canadian and US business days). Transactions placed outside these hours or on weekends/holidays will be pending for the next business day. Please note that for pending transactions, the displayed foreign exchange is an indication only, the actual conversion value will be determined once the transaction is booked and can be viewed on the Transfer History tab on the Transfer Cash & Foreign Exchange page or on the Activity History page.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2018. All rights reserved.