What Rising Interest Rates Can Mean for Investors

Written by The Inspired Investor Team

Published on March 1, 2022

minute read

Share:

With inflation climbing in both Canada and the U.S., expectations for multiple interest-rate hikes in both countries are also on the rise.

What does an interest rate hike mean for investors? Here are a few considerations:

Fixed Income

The fixed-income family includes many types of investments, including bonds, treasury bills, bankers' acceptances, guaranteed investment certificates (GICs) and mortgage-backed securities. Here we'll focus on bonds to show the possible impact of rising interest rates.

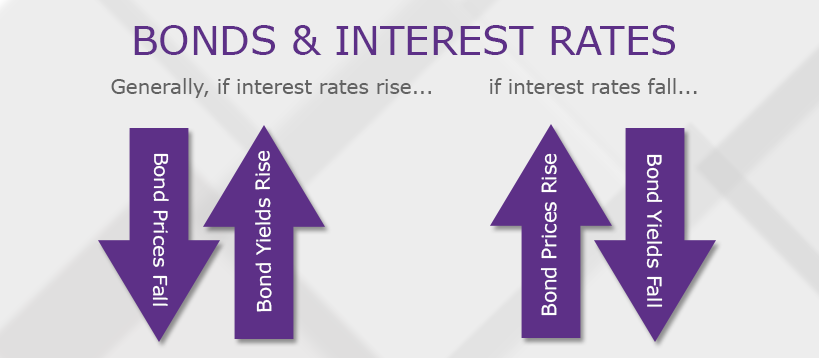

When markets start to anticipate an increase in rates, bond yields can head higher.

Interest rate moves can be challenging for bonds as the price of bonds tends to have an inverse relationship with interest rates. As one of a few factors that bonds are sensitive to (inflation risk and credit risk are others), interest rate risk refers to the risk of rising interest rates and a reduction in the market value of a bond. Why does this happen? A bond's price may fall to reflect its lower coupon rate relative to comparable bonds issued more recently at higher rates. At the same time as its price declines, the bond's yield moves higher, keeping it competitive in the market.

While the price of existing bonds may drop as rates rise, interest income could benefit if reinvested at a higher rate. Existing bonds in the market might also be available at higher yields, or new bonds may be issued with more attractive coupons.

Keep In Mind

- Holding a bond until it matures means fluctuations in its market price would have less impact on the holder. That's because interest payments are predictable over the life of the bond, and the principle would likely be paid out upon maturity, providing the issuer doesn't default.

- While fixed-income returns may come under pressure in the short-term, a strategic allocation to fixed income is still considered by many to be a key ingredient in a well-diversified portfolio.

Stocks

Traditional thinking is that rising interest rates create headwinds for equities. There are a few reasons behind this point of view:

- Higher rates can mean higher borrowing costs for companies, which risks impacting their return on capital.

- Higher rates can sometimes make more secure, interest-bearing instruments like bonds more attractive to investors, which may result in lower demand for stocks.

- Higher rates may mean companies spend more to service debt and less on capital investments, which may affect future earnings growth.

But…

It's important to keep in mind the reasons behind interest-rate hikes. For some companies, a strong economy can help drive corporate earnings.

Margin Accounts

Have a margin account? A rise in the cost of borrowing can mean you have to pay more to leverage (or borrow) against your existing investments.

Learn more about inflation in What is Inflation and How Does it Affect Investors?

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2022.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Explore More

7 Ways to Get Ahead Financially in 2026

How you might invigorate your finances and put your money to work more intentionally this year

minute read

Economic Outlook: Uncertainty is Here to Stay, So What's Next?

Takeaways from the Economic Club of Canada’s Annual Event

minute read

3 things: Week of December 15

What the Inspired Investor team is watching this week

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.