Future Housing Affordability in Canada Looks 'Grim': Report

Written by Robert Hogue

Published on April 1, 2022

minute read

Share:

The following report was first published by RBC Economics on March 30, 2022 under the title, "Housing affordability spiraling to worrisome levels."

Highlights

- Market frenzy drives up ownership costs to extremes: RBC's aggregate affordability measure for Canada was at its worst level in 31 years in the fourth quarter of 2021, rising 1.6 percentage points to 49.4%. The deterioration over the past year is a near-record 7.2 percentage points—exceeded only once in 1990.

- Seriously tighter squeeze in Toronto, Vancouver and Victoria: Soaring prices are crushing affordability in those markets, as well as others in southern Ontario. The deteriorating trend, however, is widespread with the RBC measure up in all markets we track in the past 12 months.

- Situation isn't as strained in the Prairies and some east-coast markets: Ownership costs in these regions still generally look manageable so far. Halifax is an emerging exception.

- The outlook for affordability is grim: Rapid price escalation in the early months of 2022 has already raised the bar to impossible levels for many homebuyers. And with the Bank of Canada now in the process of hiking interest rates materially—we expect a total increase of at least 150 basis points in the coming year—ownership costs look set to spiral even higher. Worst-ever affordability levels could well ensue, putting buyers in a precarious spot.

Home prices detached from buyer reality in many areas

Price gains recorded during the pandemic have been nothing short of stunning across Canada, surpassing 30 per cent nationwide and far more in several markets.

There were good reasons for prices to go up: changing housing needs, strong household incomes (including government pandemic supports), and rock-bottom interest rates have supercharged demand while regulatory and administrative obstacles significantly held back the supply response, creating market imbalances of epic proportions. Increased investor participation further stirred up the buying frenzy and widened the gulf between demand and supply. Still, the extent to which prices have appreciated clearly went beyond what solid fundamentals would suggest in many parts of the country.

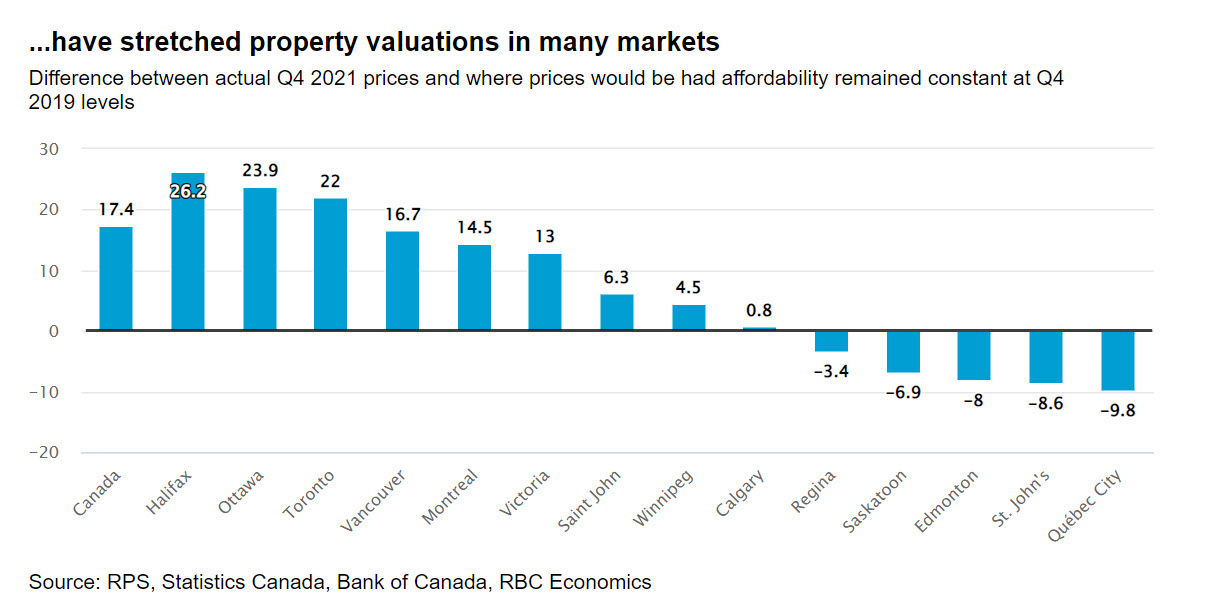

In the fourth quarter of 2021, the aggregate price in Canada exceeded by 17 per cent what the value would have been if Canadians had dedicated the same proportion of their income toward ownership costs (RBC's affordability measure) as just before the pandemic. In other words, Canadians paid a 17 per cent premium over late-2019 valuations—which were already quite steep. That premium was considerably more in Halifax (26 per cent), Ottawa (24 per cent) and Toronto (22 per cent), and slightly less—though still substantial—in Vancouver (16.7 per cent), Montreal (15 per cent) and Victoria (13 per cent).

We see large departures from historical norms as signs that prices have detached from local buyers' realities. Whether lofty valuations can be sustained will largely depend on how long demand-supply conditions remain ultra-tight and market sentiment stays bullish. We think a large (and likely rapid) increase in interest rates in time will bring about significant changes: cooler demand, easing imbalances and possibly dampening expectations.

.jpg)

Higher sensitivity to interest rates to add stress

Canadian homebuyers are a lot more sensitive to interest rate changes than they were 10 or 15 years ago as today's sky-high prices amplify the impact on mortgage payments. A one percentage-point rise in rates currently would boost payments by $315 per month for a standard home in Canada (valued at $775,000), or roughly double what the increase would have been 10 years ago. Relative to household income, the impact is two-thirds larger now. Everything else equal, a 150 basis-point rise in rates—our call for the Bank of Canada—would propel RBC's composite affordability measure for Canada by more than 7 percentage points (a rise represents a loss of affordability). While income gains will provide a partial offset, it's entirely possible RBC's measure could spike to all-time highs in the year ahead. A shock of this magnitude would severely stress homebuyers and exert significant downward pressure on demand.

Vancouver, Toronto and Victoria more sensitive to rate hikes

Every buyer across the country will feel the pinch of rising rates. But buyers in the most expensive markets will feel it most. That's because interest rate fluctuations affect mortgage payments more in Vancouver, Toronto and Victoria where mortgage sizes significantly exceed the national average. RBC's aggregate affordability measure could easily surpass previous peaks in all three markets. Buyers in Montreal, Ottawa and, to a lesser extent, Halifax also face further material erosion of affordability. Most of Atlantic Canada and the Prairies, on the other hand, are relatively less sensitive, containing downward pressure on demand.

Many coping mechanisms available

We expect many buyers will shift their preferences to keep their ownership dream alive in a rising rate environment. This may include looking for a more modest home or a different type of home (for example, a condo instead of a single family home); considering more affordable neighbourhoods, cities or provinces; opting for a type of mortgage with a lower rate (variable instead of fixed) or longer amortization; renting out part of the property to generate additional income; exploring co-ownership or other alternative ownership arrangements; and asking mom and dad for a gift (or a larger gift) toward down payment. These coping mechanisms would cushion the impact of rising rates on demand. Soaring immigration—with Canada further upping its immigration targets for the next three years—is also poised to soften the blow to a certain degree.

Find the full Housing Trends and Affordability report at rbc.com/economics

Robert Hogue is a member of the Macroeconomic and Regional Analysis Group, with RBC Economics. He is responsible for providing analysis and forecasts for the Canadian housing market and for the provincial economies.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2022.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Explore More

Here’s What Every Canadian Should Know About Estate Planning

Insights from Leanne Kaufman to help you feel more confident as you plan

minute read

3 Things We're Watching This Week

What the Inspired Investor team is watching

minute read

What’s Driving the Recent Surge in Gold Prices

Here are some things to watch with the gold market

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.