Five Terms to Keep in Mind During Trump’s Second Presidency

Written by The Inspired Investor Team | Published on November 20, 2024

Written by The Inspired Investor Team | Published on November 20, 2024

After two years of anticipation over who would become the 47th U.S. president, investors can now focus on what a second Donald Trump presidency – plus a Republican Senate and House – might look like.

It’s still too early to know precisely which of the policies Trump touted on the campaign trail he may enact or how far he’ll go with some of his more controversial pronouncements, but, based on his history, there are a few key terms that investors should familiarize themselves with, as you may hear them over the next four years.

Tariffs: Tariffs were a main pillar of Trump’s platform, specifically a blanket 10 to 20 per cent tax on all imported goods and a 60 per cent levy on all Chinese products.1 Given that he previously imposed about US$380 billion2 in tariffs on imported goods, it’s possible he will make good on this part of his platform – and soon. “(It’s an) area that the president… doesn’t have to wait for Congress to get in gear,” said Eric Lascelles, Chief Economist at RBC Global Asset Management (RBC GAM), in a post-election video.3 “We expect partial tariffs, but not full tariffs, and we’re not convinced there will be a blanket 10 per cent tariff on the world.”

Trump trade: This refers to the way investors and markets react to the economic and political policies related to a potential Trump presidency. Stocks rose sharply the day after the election, just as they did after his 2016 election win,4 which signals how much markets care about taxes and regulations, said Lascelles. “Trump is proposing to reduce regulations, cut taxes and make life easier for oil companies,” he said. “That combination is considered stock market positive.” While speaking on a podcast, Stu Kedwell, Managing Director, Senior Portfolio Manager and Co-Head of North American Equities at RBC GAM, said that while you can’t know whether the markets will continue climbing, what’s driving the post-election gains isn’t going away.5 “The likelihood for some lower taxes, a bit more slope in the yield curve, more M&A activity, more capital markets activity, less sand in the gears on regulation – that's been pretty consistent.”

Trumpenomics: This was the term used to describe Trump’s economic agenda when he was first in power, and now that he’s back, some are already talking about Trumpenomics 2.0. On the campaign trail, the incoming president discussed tax cuts, reducing regulation and tightening immigration,6 which would impact the economy, among other things. “Neither candidate had a massively stimulative platform,” says Lascelles. “We don’t think the deficit leaps higher here. We’re not looking for a big jump in economic growth, but we think it is a platform that on the net is perhaps slightly supportive of the economy, at a minimum, and doesn’t impose a drag.”

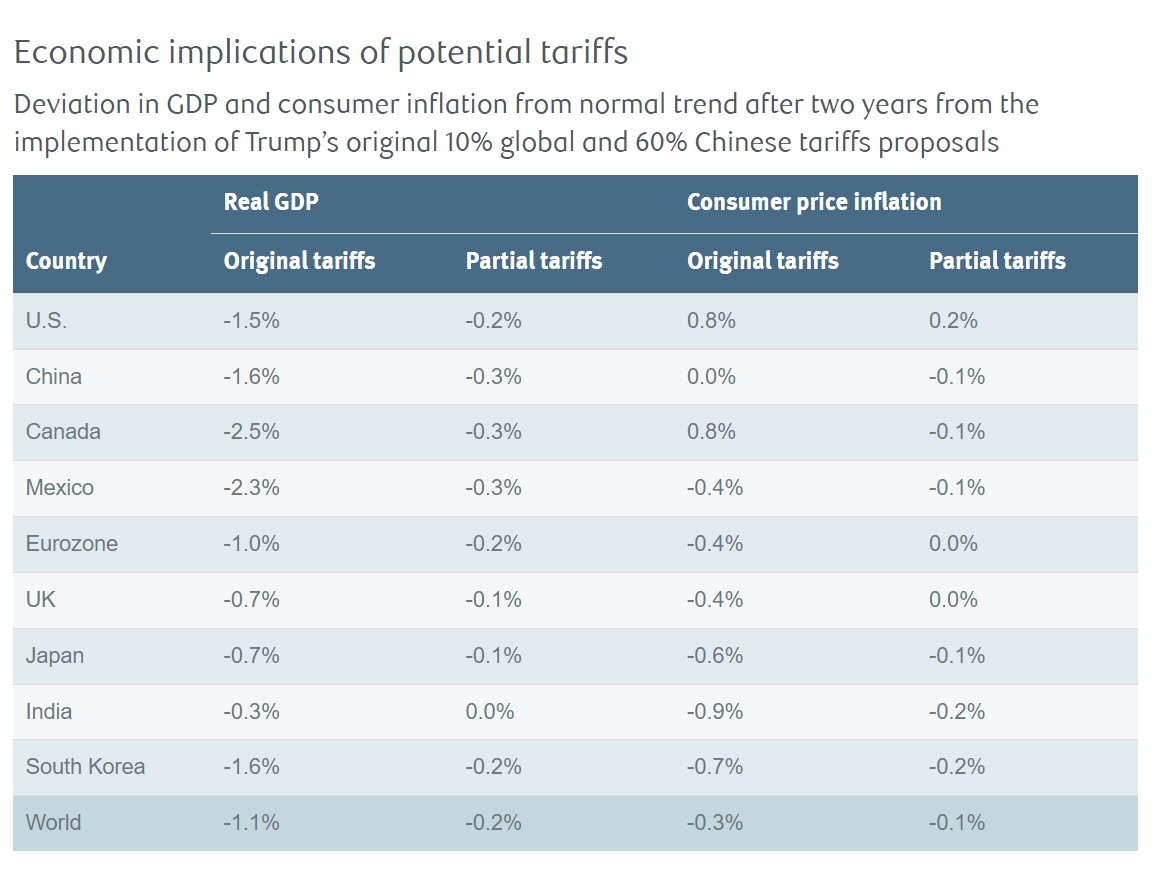

Inflation: While inflation is by no means a new idea – it’s been on everyone’s minds for over two years – you can expect to hear the word more going forward. Many say that Trump’s tariffs could increase the cost of all sorts of goods while lowering U.S. GDP. RBC estimates that over the next two years the American economy could be 0.2 per cent smaller, while inflation could be 0.8 per cent higher than it otherwise would.7 Here’s the impact tariffs could have on GDP and inflation elsewhere.

Source: RBC Global Asset Management Inc., Chief Economist Eric Lascelles, date as of 8/5/24.

Still, some other policies Trump has discussed could offset those higher costs. “A friendlier oil policy and the greater ability perhaps to drill for oil could actually be slightly deflationary,” said Lascelles. “(Inflation) could be resolved via central banks that don’t cut rates quite as much.”

Geopolitics: The clear Republican victory in the 2024 election seems to respond to economic uncertainty in the U.S., for small businesses in particular. The same can’t be said for the rest of the world. With Trump back in the Oval Office, other countries may be forced to increase military spending and redraw alliances. Although Trump’s proposed tariffs8 could have a negative impact on trade, the tax cuts many anticipate will flow out of this administration could blunt that issue. “U.S. tax cuts render other countries a little bit less competitive in comparison,” explained Lascelles.

While a second Trump presidency could have far-reaching implications for the economy, investors should remember that (as the chart below shows) the economy’s performance is not directly correlated with which party is in power – markets have historically done well at times when Republicans were in power and other times when Democrats were in power. That may be in part because the stock market’s performance is also driven by the innovations and decision-making within companies themselves..png)

Source: RBC Wealth Management, Bloomberg Chief Economist Eric Lascelles, data through 12/31/23; data based on price returns (does not include dividends).

As Lascelles concluded in his post-election recap, the vote isn't the only thing that matters to markets. “We are going to learn more in the coming days and months,” he said. “Stay tuned.”

1 Source: Tax Foundation, "Revenue Estimates of Trump's Universal Baseline Tariffs", November 2024

2 Source: Tax Foundation, "Tariff Tracker: Tracking the Economic Impact of the Trump-Biden Tariffs", June 2024

3 Source: RBC Global Asset Management, "2024 U.S. Election Highlights: A New Chapter Begins", November 2024

4 Source: S&P Capital IQ, S&P 500 chart of November 5th, 2024 to close on November 7, 2024

5 Source: RBC Global Asset Management, "U.S. post-election insights: Stocks rally after Trump's win", November 2024

6 Source: Reuters, "What are Trump's policies on trade, immigration and other key issues?", November 2024

7 Source: RBC Wealth Management, "U.S. presidential election: Back to the future", November 2024

8 Source: Reuters, "Trump unlikely to impose full tariff plan - S&P Global", November 2024

RBC Direct Investing Inc., RBC Global Asset Management Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2024.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. Information available on the RBC Direct Investing website is intended for access by residents of Canada only, and should not be accessed from any jurisdiction outside Canada.

Here’s what we saw on the trading floor in June 2025

Valerie Grimba unpacks emerging ETF trends and insights

What the Inspired Investor team is watching