Canadian Home Prices Expected to Continue to Drop

Written by Robert Hogue | Published on July 22, 2022

Written by Robert Hogue | Published on July 22, 2022

Canadian home prices are dropping faster and faster, especially in Ontario and parts of British Columbia as big interest rate hikes increasingly take a toll on buyers.

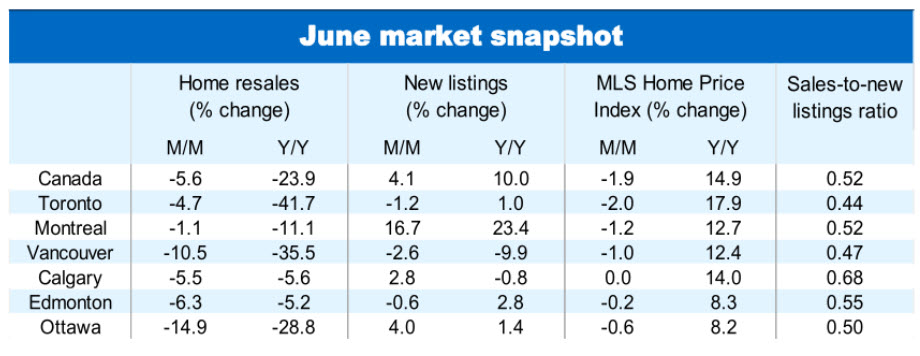

The national aggregate MLS Home Price Index (HPI) recorded its largest-ever one-month decline (-1.9 per cent) in June, following drops of 1.0 per cent in April and 0.5 per cent in May. The price correction is concentrated in Ontario where the MLS HPI fell in all markets last month—significantly so in cottage country, London, Woodstock, Kitchener-Waterloo and other areas that saw tremendous appreciation during the pandemic. Property values are also trending down more rapidly in British Columbia's Interior and Lower Mainland regions, with June marking the steepest drop in the MLS HPI of the past three months.

Other parts of the country are now beginning to see softening prices. The MLS HPI fell in Winnipeg, Montreal and Quebec City from May to June, which we think will mark a turning point. Calgary and Halifax may not be far behind with the index largely flat last month. These developments fit our view that property values will come under increasing downward pressure across Canada over the coming months with pricier markets on the front line of that trend.

Earlier (super) tight demand-supply conditions are easing rapidly. Home resales in Canada are down 27 per cent since February, including a 5.6 per cent month-over-month drop in June. This occurred while the number of homes put up for sale increased slightly, giving buyers more options to pick from—and significantly reducing the degree of competition between them. Resale activity fell in the vast majority of markets between May and June with the few exceptions mainly found in Quebec and parts of Atlantic Canada. Declines were strongest in Ontario and British Columbia—as was the case in previous months—where buyers are most sensitive to the rise in interest rates.

The outsized 100 basis-point rate increase the Bank of Canada delivered on July 13 will no doubt chill the market even more in the coming months. Higher mortgage rates will spoil or delay homeownership plans for many buyers, especially in British Columbia and Ontario where affordability is particularly stretched. The prospects for further rate hikes—we believe our central bank will raise its policy rate to restrictive levels by the fall—will deepen the correction in both provinces, and broaden it to other parts of the country. We project home resales to fall 34 per cent and benchmark prices by close to 13 per cent by early next year in Canada.

The local market impact of higher rates will be uneven, though. We expect the pricier—and more interest-sensitive—markets (e.g. Vancouver and Toronto) and housing categories (e.g. single-detached homes) to face larger declines, while relatively affordable areas (e.g. Calgary, much of Atlantic Canada) and options (e.g. condos) to show greater resilience. On a provincial basis, we think Ontario and British Columbia could record peak-to-trough benchmark price declines exceeding 14 per cent, and see Alberta and Saskatchewan at the other end of the scale with drops of less than 3 per cent.

Source: RBC Economics

Find the full Housing Market Update at rbc.com/economics.

Robert Hogue is a member of the Macroeconomic and Regional Analysis Group, with RBC Economics. He is responsible for providing analysis and forecasts for the Canadian housing market and for the provincial economies.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2022.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently a resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Valerie Grimba unpacks emerging ETF trends and insights

Tariff-driven job losses emerge, yet some see reason for optimism

The following report was first published by RBC Economics on July 15, 2022 under the title, "Canada's housing market correction gets more serious."