Canada's Inflation Rate Hits Highest Level Since 1991

Written by RBC Economics | Published on March 18, 2022

Written by RBC Economics | Published on March 18, 2022

This report was first published by RBC Economics on March 16 under the title, “Canada's inflation hit 5.7% and price pressures broaden in February"

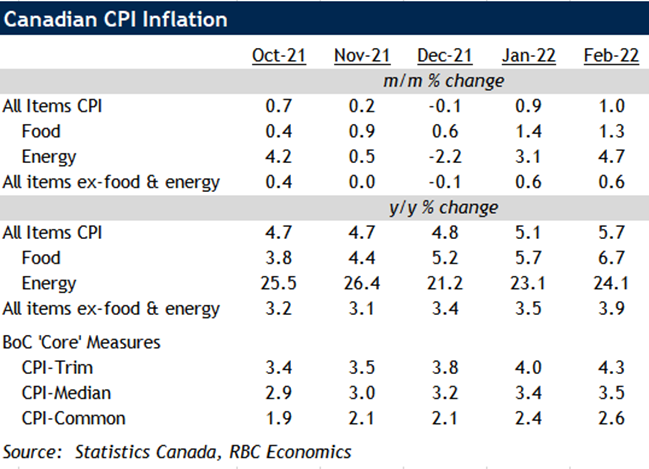

Canada headline consumer price index (CPI) rose to 5.7 per cent in February, the highest level since 1991 (the year the Bank of Canada first announced an inflation target). Almost half of that gain can be traced to growth in food and energy prices.

Shoppers paid substantially higher for food in February — 6.7 per cent over year ago levels, with prices up both at grocery stores and restaurants. Energy prices also increased, climbing 24 per cent in February from a year ago, and that growth likely accelerated into March with the Russian invasion of Ukraine sending oil (and gasoline) prices sharply higher. The prices of some metal and agricultural products have also spiked higher, and will add to inflation pressures down the road.

There is little that the Bank of Canada can do to influence global commodity prices, but domestic price pressures also continue to broaden. Shelter costs have surged 6.6 per cent from a year ago with heated housing markets boosting resale prices, and vehicle prices are still high as suppliers have struggled to keep up with demand due to global supply chain disruptions.

Roughly 65 per cent of the CPI basket was growing above the central bank's target 2 per cent versus pre-pandemic levels in February. Geopolitical risks have intensified, but firming inflationary pressures alongside tightening labour markets make a strong case for the Bank of Canada to raise rates from emergency low levels, and we expect the Bank of Canada will hike the policy rate by another 25 basis points in April.

Find the full report, plus the RBC Inflation Watch tracker, at rbc.com/economics.

This report was authored by RBC Economist Rannella Billy-Ochieng.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2022.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Here’s what we saw on the trading floor in June 2025

Valerie Grimba unpacks emerging ETF trends and insights

What the Inspired Investor team is watching