What Investors Should Know About Bear Markets

Written by RBC Global Asset Management

Published on June 23, 2022

minute read

Share:

The following report was first published by RBC Global Asset Management on June 13, 2022 under the title, "Examining Bear Markets."

Investors are facing a lot of uncertainty these days. In these situations, it's important to remember that while the volatility feels uncomfortable, markets have proven resilient over time. Remaining focused on the long term helps ensure investors stay true to their plan. As long-term investors know, over the life of their investments there are inevitably times when uncertainty prevails and markets aren't able to shake off the headlines.

With the benefit of hindsight, these memorable days often look like attractive times to invest. However, in the moment they often feel like anything but. With the market recently dipping into bear market territory (deemed as a 20 per cent decline from the market highs), many wonder: What does this mean for their investments? When are markets going to turn around? While predicting the near-term direction of markets is incredibly difficult, history provides some good context for the long-term direction.

How often do bear markets occur?

• Over the past 60 years, U.S. equities have experienced 10 distinct bear market events. On average, they tend to occur every 7 years.

• The last bear market occurred in 2020. It was the quickest one on record, dropping 20% in one month and recovering within 6 months.

• The decline associated with these bear market events, along with their subsequent market recoveries (back to the preceding all-time high), account for half of all trading days.

This suggests bear markets and their recoveries are a regular part of long-term investing. Despite how painful and unusual it feels at the time, the occurrence of a bear market is not, in of itself, an abnormal experience.

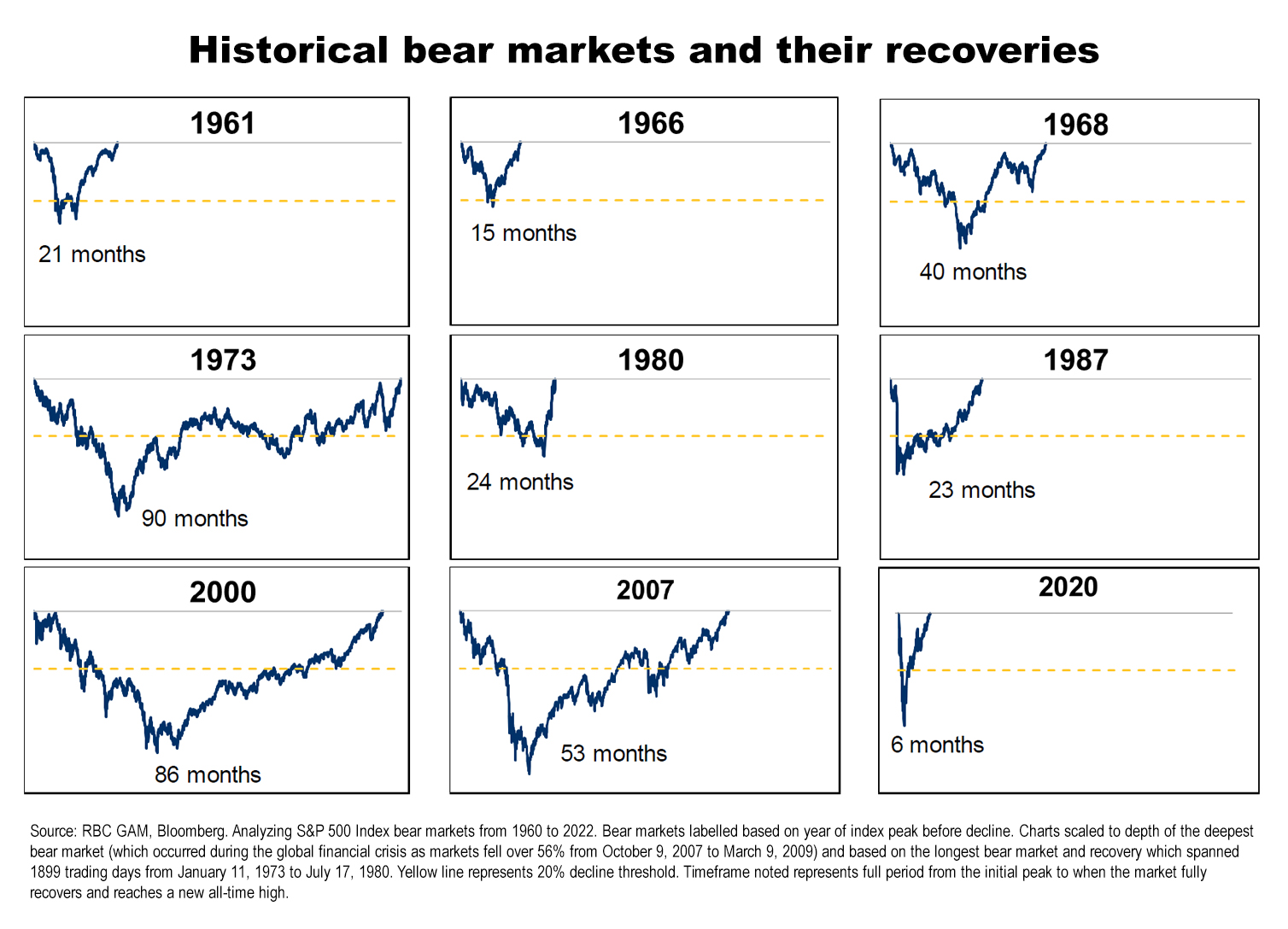

What do bear market recoveries normally look like?

As the chart below shows, there's no real 'normal' when it comes to bear markets. They come in all sorts of shapes and sizes.

Key takeaways:

• On the way down. Some bear markets find their bottom quickly. For example, Black Monday in 1987 bottomed out after just 39 days. Others may take a bit longer. Following the Tech Wreck in 2000, it took markets nearly 2.5 years to find a bottom as other events such as 9/11 and a wave of accounting scandals weighed on investors. On average, the bottom occurs about 14 months after the peak. Today's bear market drawdown has so far occurred over a period of about 5 months.

• On the way back up. Some recoveries occurred very quickly. In the early 1980s, we saw markets bottom and set all-time highs within 59 days. Other recoveries took longer. For instance, it took markets over 5 years to recover from the 1973-74 market crash, though that largely was a result of rolling recessions over the same period. What seems to matter the most when it comes to recovery periods is whether a recession occurred at the same time and the direction of monetary policy.

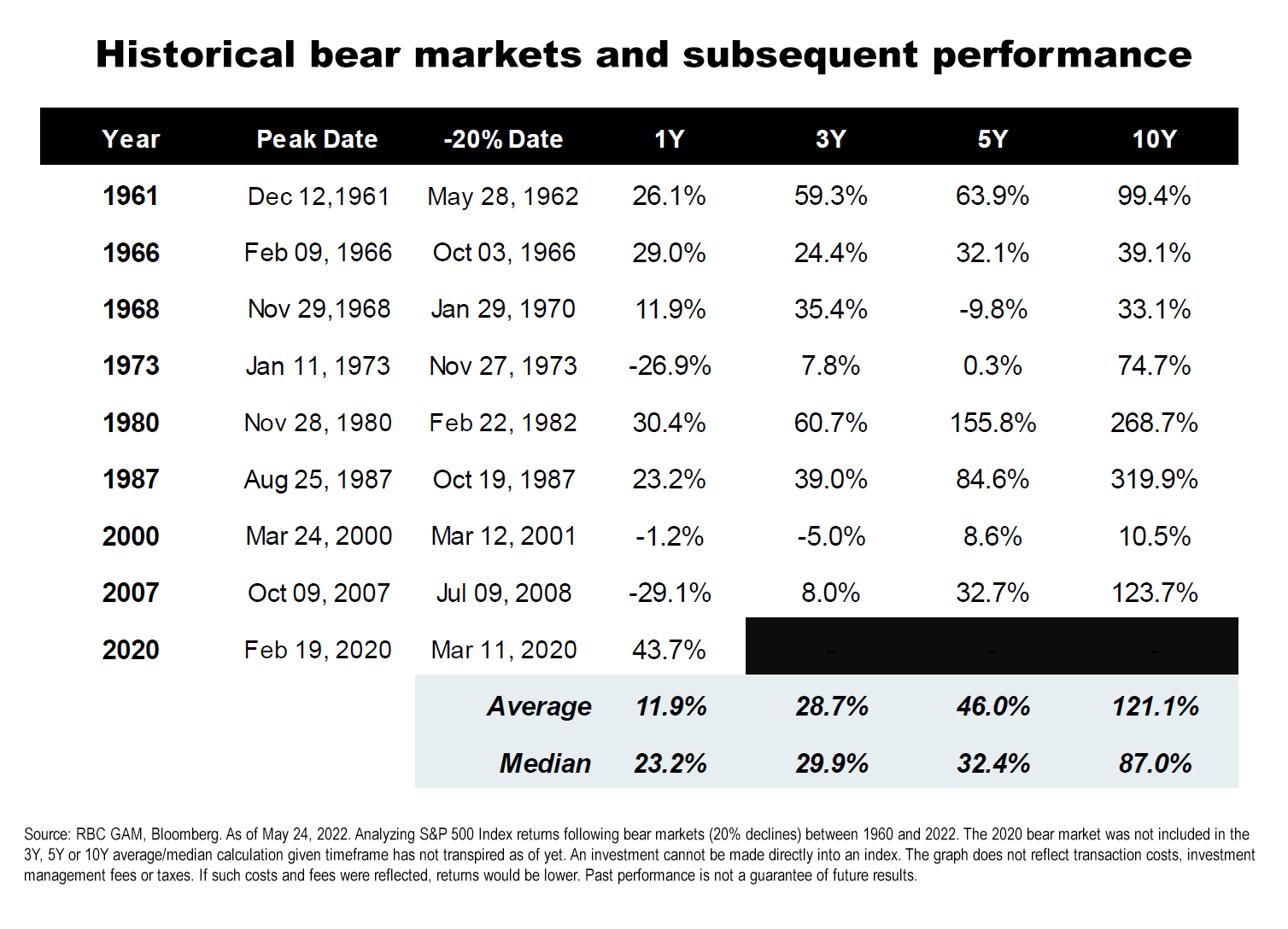

All this goes to show that, while the market movements we've seen in 2022 may have us feeling quite uncomfortable, once investors begin to see the path toward recovery, markets tend to quickly follow. Not every bear market needs to be as deep as that experienced during the Global Financial Crisis, nor have a recovery as long as that experienced in the 1970s. In fact, as the chart below shows, returns in the years following bear markets are quite strong on average.

Investors are facing a lot of uncertainty these days. In these situations, it's important to remember that while the volatility feels uncomfortable, markets have proven resilient over time. Remaining focused on the long term helps ensure investors stay true to their plan.

Find more from RBC Global Asset Management at https://www.rbcgam.com.

RBC Direct Investing Inc., RBC Global Asset Management Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2022.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently a resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Explore More

Economic Outlook: Uncertainty is Here to Stay, So What's Next?

Takeaways from the Economic Club of Canada’s Annual Event

minute read

3 things: Week of December 15

What the Inspired Investor team is watching this week

minute read

Year in Review: Tariffs, Tech, Rates and More

Looking back at some major stories of 2025, plus lessons investors can take into the new year

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.