How Your Portfolio Could Be Like a Playlist

Written by The Inspired Investor Team

Published on November 4, 2025

minute read

Share:

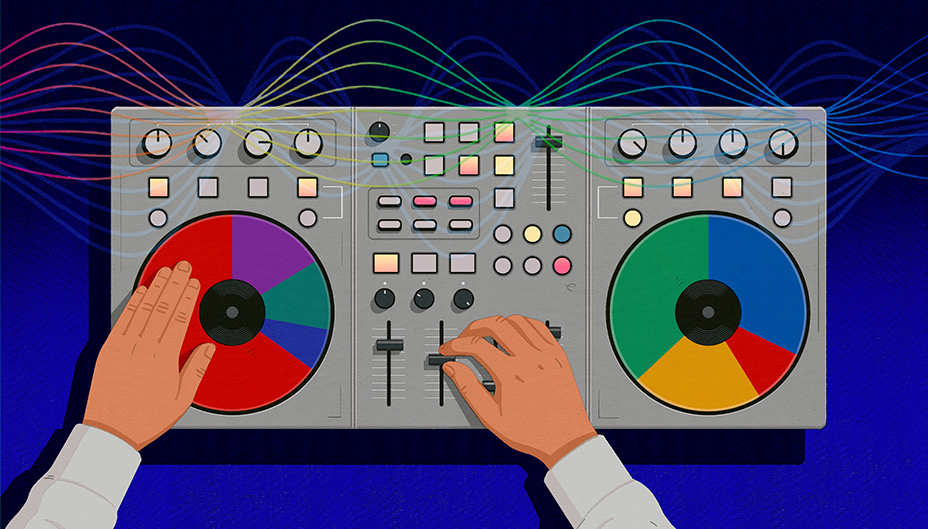

Diversification has long been a key part of creating a long-term portfolio, but for those new to investing, the concept may not be as simple as you might expect. Building a diversified portfolio, though, is not unlike creating the perfect music playlist. If you've ever put one on at a party, you’ll know it can be a good idea to include a wide range of tunes to keep people going. Here's how portfolio and playlist creation are one and the same.

A mix of music

To create a playlist, you typically bring several songs from different musicians into one place. Sure, you can put a bunch of tracks from one artist on one list, but that may not give you the variety of grooves you need to get you through a long walk or the event you’re DJing.

The same goes for your investments. You might be tempted to put a large chunk of money into one company or sector when that part of the market is performing well, but it can leave you exposed if something changes. A diversified portfolio often combines different types of investments, such as stocks, bonds and cash, and might provide exposure to different regions and industries, so no single performance dominates the mix.

It's no different than a balanced playlist: there are upbeat songs that get people dancing, mellow tracks to slow things down and maybe a few new discoveries that can amp up the excitement. Each song – or company – has a role to play, and together, they can potentially make the listening – or investing – experience more enjoyable and resilient.

Knowing your listener

When you make a playlist, it can be helpful to start by thinking about who and what occasion it's for, and what you want to get out of it. A workout playlist might be filled with high-energy tracks, while a dinner party list might call for something more relaxed. You tailor the mix to the audience and mood.

Investing is similar. Creating the right portfolio for your needs can depend on factors including your goals, time horizon and comfort level with risk. Are you the type of investor who can handle some volatility? You might tilt more toward equities or growth-oriented securities. If you’d prefer to play it safer, you may choose to include GICs, bonds or income-generating investments.

Similar to how a playlist might rely more heavily on one sound over another, your security selection could lean more toward one area. Diversified portfolios, though, often have a mix of growth and value, stocks and bonds and more. The key is knowing your tastes or risk profile and building accordingly.

One-hit wonders

Every music listener knows the temptation of chasing the latest chart-topper. It’s catchy, everyone’s listening to it, and it might light up the dance floor – for now. But over time, those trendy songs can fade. A great playlist stands the test of time with tracks you’ll still love years from now.

Investors face the same challenge. When a hot stock or sector grabs headlines, it’s easy to want to load up on what’s popular. But markets, like music trends, tend to be cyclical1. Today’s star performer might not be tomorrow’s big hit. Diversification could help keep you from relying on “one-hit wonders.”

Multiple tempos

One thing some of the best playlists take into account is good flow. You typically wouldn’t want 10 slow songs in a row or 10 hard-driving anthems back-to-back – a blend tempos and styles is probably more likely to keep people engaged. Similarly, your portfolio benefits from having a mix of assets that respond differently to market conditions.

Stocks tend to do well during periods of economic growth, while GICs could provide stability. Cash could help you take advantage of new opportunities, while alternatives, such as real estate or infrastructure, could add another layer of diversification. Covering different types of investments can help smooth out the ride over time.

Revisit and remix

A playlist isn’t something you make once and never touch again. New songs come out, your mood changes and maybe you discover a new genre. The same goes for your portfolio. Checking in periodically can help ensure your investments still match your goals.

If one type of investment has grown faster than the others, your portfolio might be out of balance – like a playlist that’s 80 per cent dance music. Rebalancing helps bring things back into harmony, ensuring your overall mix still reflects your intended strategy.

Building a playlist and building a portfolio come down to the same challenge: balance. At the same time, whether you’re a rock purist or a genre-hopper, a conservative investor or a growth-seeker, it’s all about the mix. By understanding your style and personal goals, spreading your investments across different "tracks", and revisiting your list from time to time, you can create a financial soundtrack that plays well today – and keeps performing for years to come.

- RBC Global Asset Management, “Understanding the Economic and Stock Market Cycles”, 2009

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2025.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. Information available on the RBC Direct Investing website is intended for access by residents of Canada only, and should not be accessed from any jurisdiction outside Canada.

Explore More

The 5 a.m. Investor: Morning Routines That Build Wealth

When it comes to building wealth, the early bird really can get the worm

minute read

Getting Stock Tips From Your Group Chat? Here’s How to Know Which Ones are Worth Exploring

When one of your pals shares a tip in the chat, you might feel inclined to act on it, but should you?

minute read

Revenge Investing and the Power of Discipline

The term is entering the lexicon – and it could help you save more of your money

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.