Reverse Stock Splits Explained

Written by The Inspired Investor Team

Published on March 26, 2021

minute read

Share:

Last updated: April 2025

A reverse stock split is a corporate action that decreases the number of outstanding shares in a company. After a reverse stock split, the price of each share is increased but the value of the company remains the same. Stock consolidation or share rollback are other terms often used to describe a reverse stock split. A sample reverse stock split could be expressed as 1 for 2 or 1:2, meaning that you will own one share for every two of a particular stock you hold and the price per share will double.

Reverse stock splits should not be confused with forward stock splits, which are the opposite in that they are corporate actions that increase the number of outstanding shares a company has (and decrease the price) by issuing more shares to current shareholders.

Why do companies use reverse stock splits?

Companies may use a reverse stock split when the stock price falls below regulations to be listed on an exchange. For example, if a company's stock is trading at 85 cents per share and the requirements to be listed on the stock exchange specify that all stocks must be priced above $1.00, the corporation may choose to complete a reverse stock split to avoid being delisted from the exchange.

Another reason a company may complete a reverse stock split is that many mutual funds and institutional investors have rules against purchasing a stock with a price below a predefined minimum. If a company is looking to remain on the radar of large investors, they may increase the price of their shares to maintain the minimum threshold set by these institutions.

If a reverse stock split has taken place, when will my account reflect the shares I hold?

It may take up to five business days for the number of shares in your account to be adjusted to the new quantity.

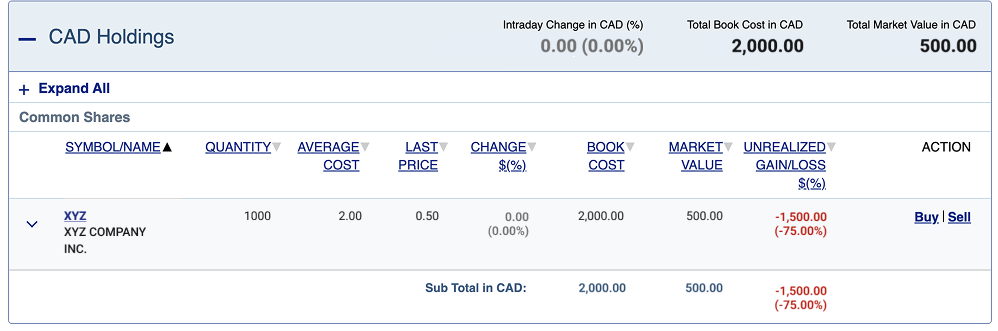

Here's an example: You own 1000 shares of Company XYZ currently trading at 50 cents per share. This would mean that prior to a reverse stock split, the value of your shares is $500 (1000 shares x 50 cents per share) as illustrated in the screenshot below:

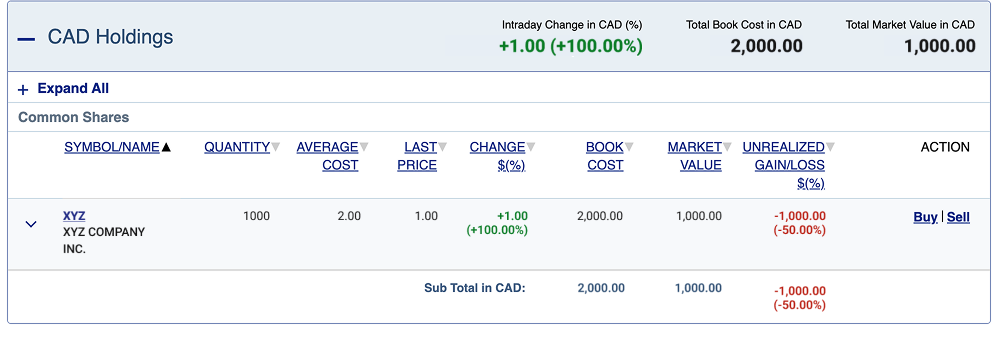

Company XYZ undergoes a 1 for 2 reverse stock split. You check your holdings shortly after the execution date and see 1000 shares valued at $1.00 per share. It looks like you have doubled your investment, but this is not the case. The number of shares in your account will update within five business days to reflect the new number of shares you hold and the price per share (500 shares x $1.00 per share). The value of your holdings remains the same at $500 (although the market price can still fluctuate, let’s say it stays at $1.00 per share for the purposes of our example).

Holdings before quantity update:

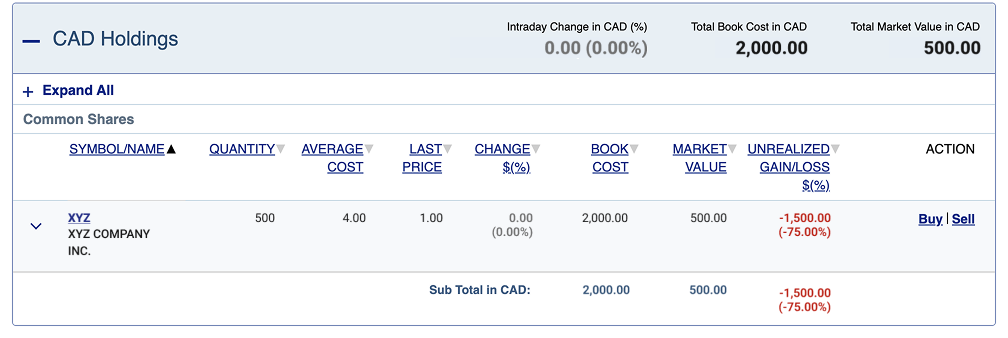

In this example of a 1 for 2 reverse stock split, before the quantity update it looks like the investment has doubled and the “Change” column shows a 100% gain. If it were a 10 for 1 reverse stock split, before the quantity update it would appear as if the investment has increased by a factor 1000%. Please keep in mind that this does not mean an increase in the value of your holdings. When the new quantity is updated, the value of the holdings would go back to what it was before the reverse stock split as illustrated below (although the market price can still fluctuate, let’s say it stays the same for the purposes of our example):

Holdings after quantity update:

If you’d like to receive email notifications of stock splits for securities in your portfolio, please update your notification preferences by going to Help > Update Your Personal Information > Email Address and Preferences > Notification Preferences to make sure “Dividends and Stock Splits” is selected.

To learn more, check out What is a Stock Split? in our Investing Academy.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2025.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. Information available on the RBC Direct Investing website is intended for access by residents of Canada only, and should not be accessed from any jurisdiction outside Canada.

Explore More

5 Ways to Get More Out of Your RESP

How can you make the most of this investment vehicle? We explain.

minute read

There's an ETF for That!

Find out more about the options that are out there

minute read

ETF Trends from the RBC Capital Markets Trading Floor – May 2025

Here’s what we saw on the trading floor in May 2025

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.