Budgeting 101 for Investors

Written by The Inspired Investor Team

Published on January 6, 2021

minute read

Share:

If your spending and saving habits have become somewhat unrecognizable lately, you're not alone. How can you make sure you're as well situated as possible? Start with a budget, says Stuart Gray, Director of RBC's Financial Planning Centre of Expertise. It may seem obvious, but people don't often recognize what they are spending on a regular basis, he says. "A budget simply helps to ensure you have enough money coming in to offset the money you are spending," says Gray. "It helps you focus your spending and understand how much you have left over to save or pay down your debt."

Some people find the idea of a budget intimidating. But, says Gray, everyone should understand their flow of income and expenditures — no matter how big or small it is. Budgeting can be quite straightforward and less painful than we might think.

Here are some key things to keep in mind:

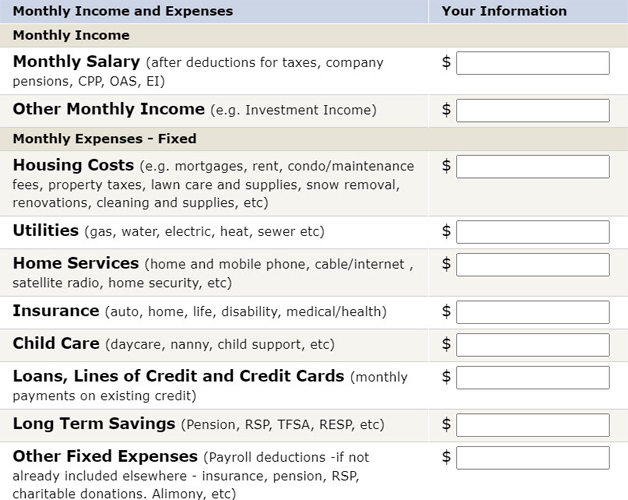

Making a budget starts with establishing our financial position — what we owe, what we own, how much is coming in and how much is going out. Just like running a small business, these are the pillars of our personal financial affairs. The budget determines how we will allocate our capital toward spending, saving and investing.

A benefit to having a budget is the ability to make longer-term strategic decisions, not just dealing with the day-to-day. For example, surplus savings could be earmarked for paying down debt, investing, building an emergency fund and/or making a charitable donation.

To use this interactive calculator, visit rbcroyalbank.com/savingsspot and look under Tools and Calculators.

Make it count: Motivate yourself by tying efforts to a greater goal or purpose, like a dream vacation.

According to Gray, one of the most common obstacles to creating a budget and sticking with it is understanding where the money goes. He recommends keeping track of one month's or one pay period's outflows. Then, he recommends, set an appropriate spend for each category such as mortgage/rent, groceries, car payments, investments, etc.

Make it fun: As you start to see where your money is going, you can get creative without sacrificing too much. Find ways to get the same — or more — through strategic spending. For example, buying soda or juice from the grocery store in bulk costs a fraction of ordering individual drinks with Friday night takeout.

Understanding your income and spending is key to knowing how much to save and invest. "You can only invest what you don't spend," says Gray. "Otherwise, you may find yourself having to redeem funds that you've saved/invested." If you are forced to sell assets during a period when the value of your investments has fallen, it will of course lock in those losses.

There are also many apps to simplify personal cash flow management. Paper and pencil work fine, or you may wish to try an app that integrates with your bank accounts to help you regularly monitor your financial situation. But, cautions Gray, you may not need to account for every dollar. "Give yourself some room to spend/save," he says.

Make it flexible: Instead of setting exact numbers to spending and saving categories, decide on a range for each. You never know when an unexpected cost — like car trouble or a vet bill — will crop up, and you don't want something like that to demotivate you.

Like everything else in life, budgets are dynamic. A saving and investing budget that is too ambitious may need to be scaled back if you find you cannot stick with it on a regular basis. Whenever there is a significant change in income or regular expenses such as a promotion, work sabbatical or a layoff, it's a good time to reevaluate the budget, says Gray.

This article was last updated in September 2022.

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence.

© Royal Bank of Canada 2022.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently a resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

Explore More

5 Ways to Get More Out of Your RESP

How can you make the most of this investment vehicle? We explain.

minute read

There's an ETF for That!

Find out more about the options that are out there

minute read

ETF Trends from the RBC Capital Markets Trading Floor – May 2025

Here’s what we saw on the trading floor in May 2025

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.