3 Ways to Keep Emotions in Check When Investing

Written by Judy McKinnon

Published on March 29, 2018

minute read

Share:

Have you ever fallen in love with a stock for all the wrong reasons? Maybe it was a hot, new trend you hadn't fully researched. Or you got caught up in the buzz of what your friends or family were doing. Maybe it worked out; maybe it didn't. We may not like to admit it, but emotions can often get the better of us when making (or not making) portfolio decisions.

"Emotions can hijack your investment decisions," RBC Behavioural Economics expert Michael Sherman said in an interview.

"While we all tend to be emotional about money, we're far better off when we approach long-term investment strategy from a cool and rational perspective," he said. "Letting emotions influence our investing decisions can often lead us astray and can result in decisions we'll regret in the long term," he added.

Getting Caught Up in the Excitement

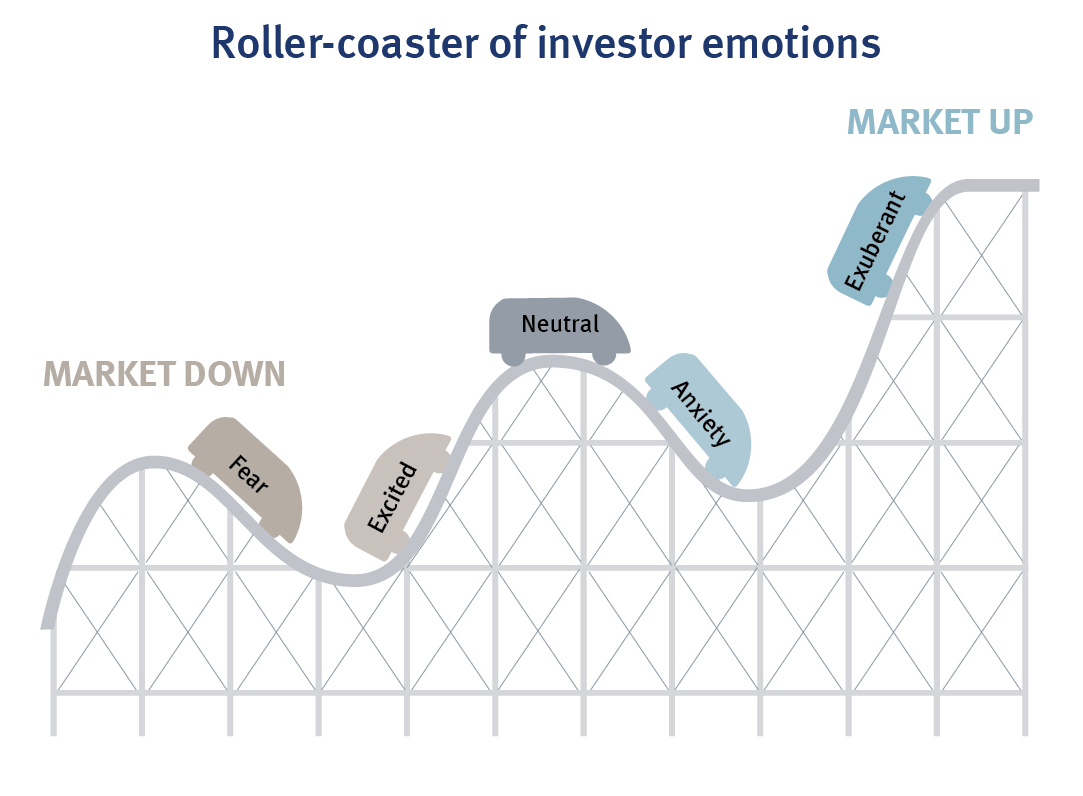

With stock markets continuing one of their longest bull runs in history, despite some recent whipsaw movements, it's hard to avoid getting caught up in the excitement. There's no shortage of tales of overnight success as certain hot investments skyrocket, which for some makes it seem like a great idea to jump on the bandwagon. Same goes for getting caught in panic mode and maybe selling prematurely when markets turn. Investing can be a roller coaster of emotions.

Source: RBC Global Asset Management

Keeping Emotions in Check

So, just how do we work to keep emotions out of our investing decisions? Here are three considerations.

- Stick to the plan. Whatever that plan is, you put it in place for a reason. It should be your guiding light to help you reach your long- or short-term goals. This can be particularly useful when markets take a turn for the worse. As Sherman points out, fluctuations are an integral part of the mechanics of markets — and assuming your investment strategy is right for you, you should be able to rest easier as markets run their course during turbulent times.

- Look at how often you're looking. Portfolio monitoring is a key part of investing in order to keep track of what's happening with our investments. And staying engaged is definitely important. Find the right monitoring schedule for you – maybe it's daily, maybe weekly, monthly, etc. Sherman says sometimes, though, the behavioural economics adage coined by psychologist Daniel Kahneman can apply here: "Nothing in life is as important as you think it is while you are thinking about it."

- Losing hurts. Seems like an obvious statement, but if we can keep in mind the concept of loss aversion, which is the theory that losses hurt far more than the enjoyment we get from gains of equal value, it may help keep knee-jerk reactions in check during volatile markets.

In short, doing the research, knowing yourself and how much risk you're comfortable with, and sticking to that plan you came up with can all help keep your emotions from overpowering your logical thoughts.

RBC Direct Investing Inc., RBC Global Asset Management Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2018. All rights reserved.

The views and opinions expressed in this publication are for your general interest and do not necessarily reflect the views and opinions of RBC Direct Investing. Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently resident of Canada, you should not access the information available on the RBC Direct Investing website.

Explore More

What Investors Can Learn from Hockey Star and RBC Olympian Sarah Nurse

Nurse's path to the podium reveals how preparation, planning and practice can turn potential into a golden opportunity

minute read

Crude Questions? A Look at Canada’s Oil Economy

What you need to know about Canada’s oil industry

minute read

How Inflation-Proof Are Your Investments?

Why inflation still matters – and how to stay ahead of it

minute read

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.